Macro Briefing: 2 May 2024

TutoSartup excerpt from this article:

* Federal Reserve leaves target rate unchanged at 5.25%-5.50% * Inflation, painful adjustment or luck are only solutions to reckless US spending * ISM Mfg Index slips back into contraction terrain in April * US job openings continued to decline in March but still relatively high * US private hiring …

Macro Briefing: 2 May 2024

Author: James Picerno

* Federal Reserve leaves target rate unchanged at 5.25%-5.50% * Inflation, painful adjustment or luck are only solutions to reckless US spending * ISM Mfg Index slips back into contraction terrain in April * US job openings continued to decline in March but still relatively high * US private hiring …

* Federal Reserve leaves target rate unchanged at 5.25%-5.50%

* Inflation, painful adjustment or luck are only solutions to reckless US spending

* ISM Mfg Index slips back into contraction terrain in April

* US job openings continued to decline in March but still relatively high

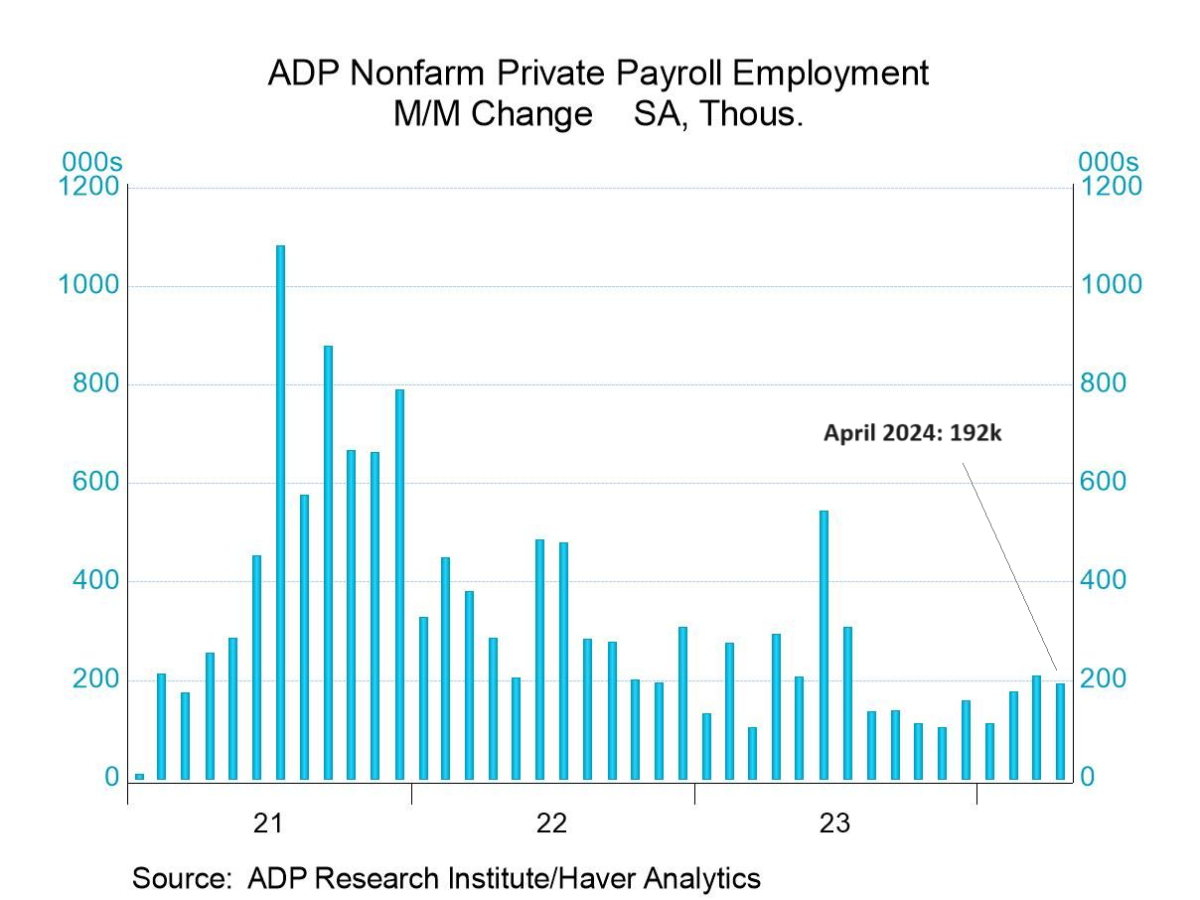

* US private hiring increases more than forecast in April:

Fed funds futures are pricing in modest odds for rate hikes in September and November after Fed Chair Jerome Powell’s dovish comments regarding rate hikes on Wednesday (May 1). But Neil Dutta, head of economic research at Renaissance Macro Research, reminds that “Powell can say whatever he wants, but ultimately the inflation numbers will dictate what happens.”

Author: James Picerno