Macro Briefing: 20 March 2024

* Federal Reserve expected to leave rates unchanged at today’s policy meeting * Economists continue ponder why high rates haven’ caused US recession * US dollar strengthens after Bank of Japan ends policy of negative rates * Rate cut for Europe on the table for June, says ECB President Lagarde *…

* Federal Reserve expected to leave rates unchanged at today’s policy meeting

* Economists continue ponder why high rates haven’ caused US recession

* US dollar strengthens after Bank of Japan ends policy of negative rates

* Rate cut for Europe on the table for June, says ECB President Lagarde

* UK inflation in February eases to slowest pace in nearly 2-1/2 years

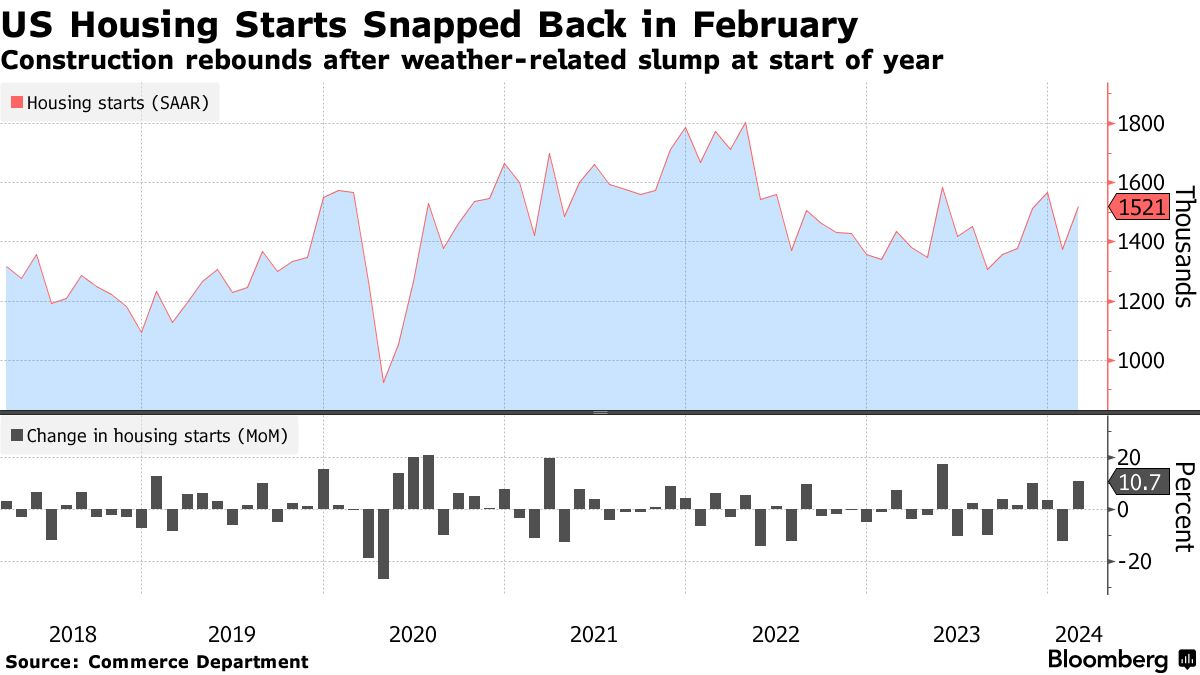

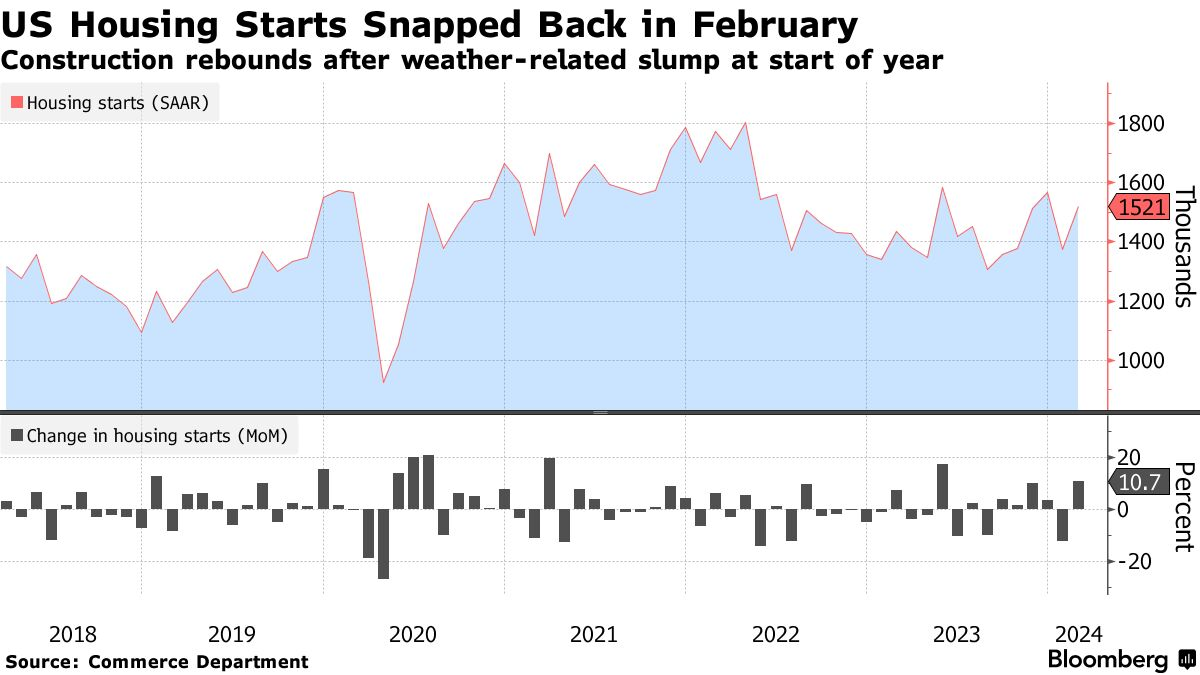

* US housing starts rebounded in February–biggest rise since May:

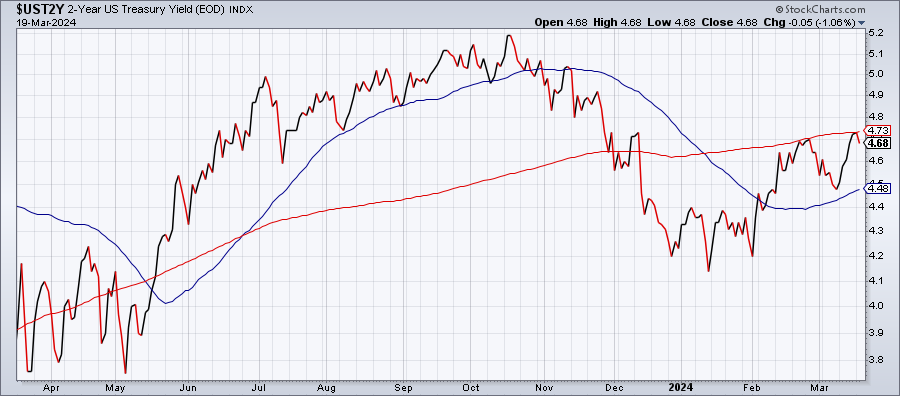

The policy-sensitive 2-year US Treasury yield eased ahead of today’s interest-rate announcement from the Federal Reserve. After reaching the highest level since December, the 2-year rate dipped on Tuesday to 4.68%. Fed funds futures this morning are pricing in near-certain odds that the Fed will leave its target rate unchanged in today’s policy announcement (due at 2pm eastern) at a 5.25%-to-5.50% range.

Author: James Picerno