Macro Briefing: 20 November 2024

US housing starts fell in October, falling 3… “Hurricanes Helene and Milton are likely to have affected housing activity during October,” advises Haver Analytics… Christopher Rupkey, chief economist at FWDBONDS, notes: “Despite the weather impact on building down in the South, the recessio…

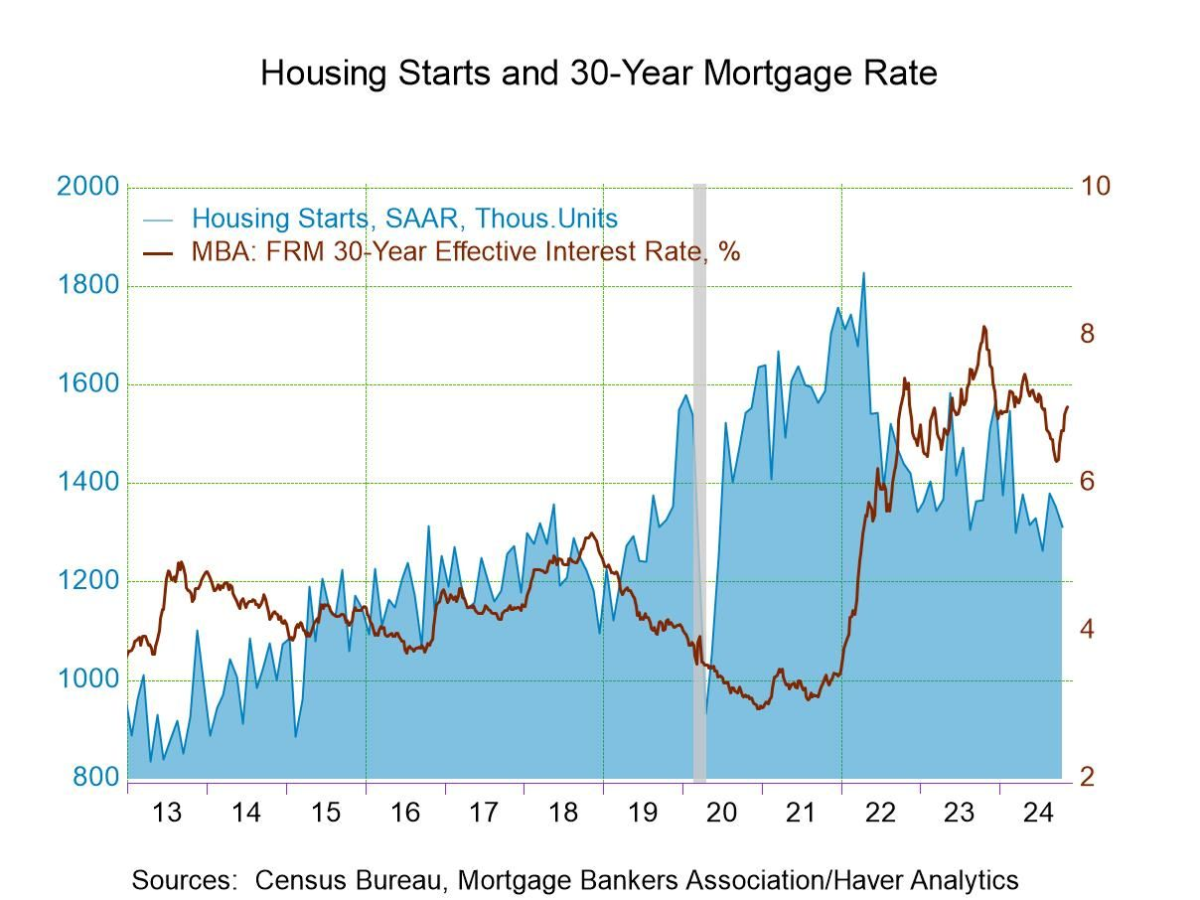

US housing starts fell in October, falling 3.1% from September and 4.0% below the year-ago level. “Hurricanes Helene and Milton are likely to have affected housing activity during October,” advises Haver Analytics. Christopher Rupkey, chief economist at FWDBONDS, notes: “Despite the weather impact on building down in the South, the recession in residential housing construction remains deep in the woods with no daylight seen for buyers facing supply shortages as they hunt for new single-family homes.”

So-called “uninvestable” China offers bargains, says veteran investment manager Howard Marks. “I’ve made my whole career buying assets that other people consider uninvestable and when you do that, you have a chance of getting a bargain,” Marks said in a Bloomberg Television interview. Comments about China being uninvestable are “music to my ears,” says co-chairman and co-founder of Oaktree Capital Management. “Clearly China is on the pile of things that people feel ill about. And it’s on that pile that you find the bargains. That doesn’t mean that you should buy everything on the pile, but that’s where you look for the castoffs and the bargains.”

Trump selects Howard Lutnick as his nominee for commerce secretary. Lutnick is head of brokerage and investment bank Cantor Fitzgerald and is a cryptocurrency enthusiast. He is also a co-chair of Trump’s transition team and is a supporter of Trump’s tariff plans.

Slow growth and high debt threaten another Eurozone crisis, warns the European Central Bank. In its annual Financial Stability Review published today, the bank advised that a potential for “market concerns over sovereign debt sustainability” and “elevated debt levels and high budget deficits” are lurking for the currency bloc. Since the previous update was published, “The balance of risks has shifted from worries that inflation will remain high to growth fears, with structurally low growth potential compounded by cyclical headwinds.”

Walmart, a retail belwether for the US, is upbeat on the holiday shopping outlook. The giant retailer lifted expectations for its net sales, which it predicts will grow between 4.8% and 5.1% for the full year. That’s above its previous forecast growth in the 3.75% -4.75% range. The upgraded forecast follows news that Walmart posted third-quarter earnings and revenue that beat expectations. Same-store sales, an widely followed industry metric, picked up to 5.3% for Walmart through the current fiscal quarter.

Author: James Picerno