Macro Briefing: 20 October 2025

If correct, the increase will tick above the strong 3…The global economy has ‘yet to feel the pain’ from tariffs, advised the European Central Bank president… China is by far the world’s largest market in 2024, representing 54% of global deployments, according to IFC data… The primar…

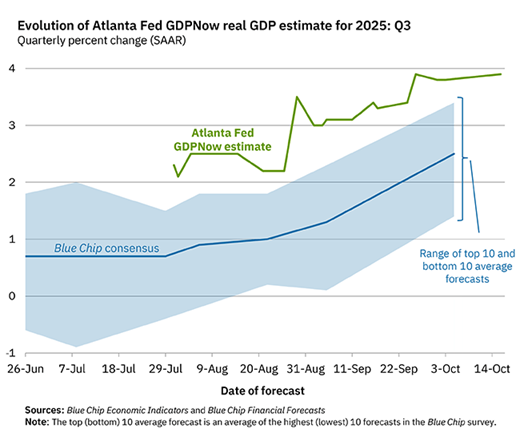

US third-quarter GDP is on track to rise 3.9%, based on the Atlanta Fed’s revised nowcast published on Friday (Oct. 17). If correct, the increase will tick above the strong 3.8% increase reported for Q2. The government’s Q3 GDP report is scheduled for Oct. 30, but the release could be delayed if the government shutdown continues.

The global economy has ‘yet to feel the pain’ from tariffs, advised the European Central Bank president. She said that exporters and importers will no longer accept smaller profit margins caused by tariffs and decide to raise prices at some point.

China’s economic growth slowed in the third quarter, rising 4.8% over the year-ago quarter. The advance marks the its weakest pace in a year, according to official data from Beijing.

Demand for industrial robots has doubled over the past ten years, reports the International Federal of Robotics. Asia accounted for 74% of new deployments in 2024, compared with 16% in Europe and 9% in the Americas. China is by far the world’s largest market in 2024, representing 54% of global deployments, according to IFC data.

The primary trend for global asset allocation strategies remains solidly bullish, reports The ETF Portfolio Strategist, a newsletter published by CapitalSpectator.com. As long as the Global Trend Indicator (GTI) trades in the upper half of the band (defined by the trailing 1-year maximum and minimum performances), upside momentum remains the baseline forecast for the near term outlook for global multi-asset-class strategies.

Author: James Picerno