Macro Briefing: 20 September 2024

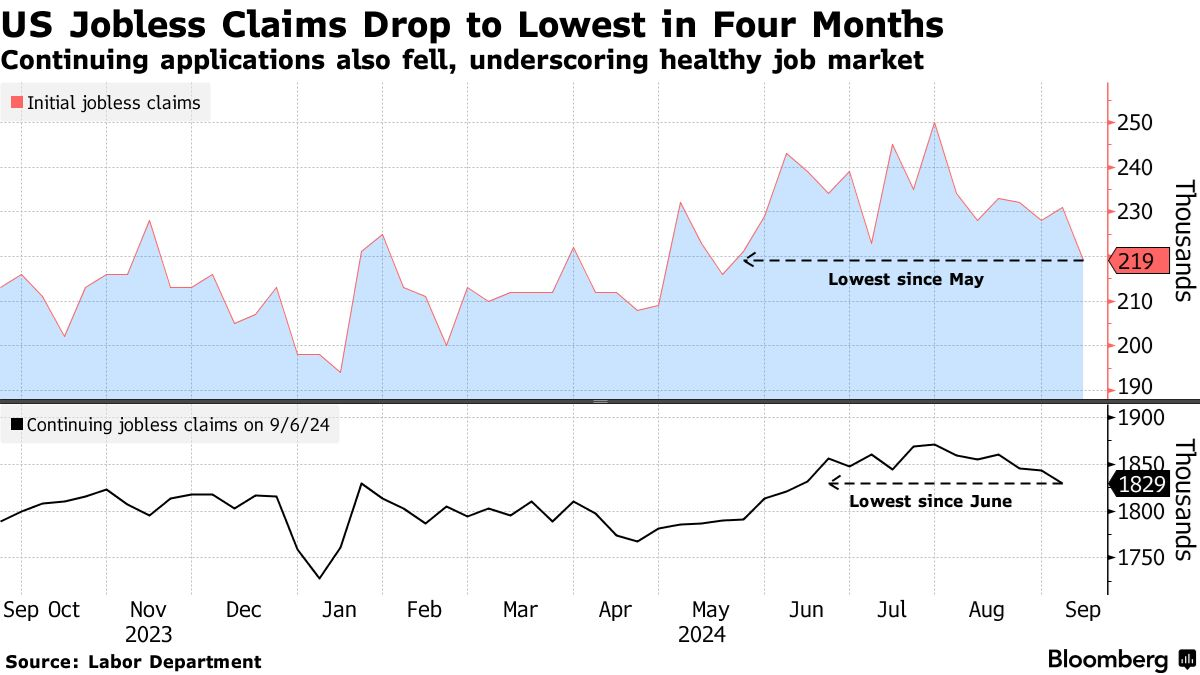

US jobless claims fell last week, dropping to the lowest level since late-May… “The labor market is softening but not imploding as you would expect in a recession… Fed policy is aimed at supporting the job market before a recession shapes up” says Carl Weinberg, chief economist at High Frequ…

US jobless claims fell last week, dropping to the lowest level since late-May. “The labor market is softening but not imploding as you would expect in a recession. Fed policy is aimed at supporting the job market before a recession shapes up” says Carl Weinberg, chief economist at High Frequency Economics.

The US Leading Economic Index fell in August to its lowest level since October 2016, the Conference Board reports. “Overall, the LEI continued to signal headwinds to economic growth ahead,” says Justyna Zabinska-La Monica, an analyst at the consultancy. “The Conference Board expects US real GDP growth to lose momentum in the second half of this year as higher prices, elevated interest rates, and mounting debt erode domestic demand.”

Sales of existing US homes fell in August to lowest level in 10 months. “Home sales were disappointing again in August, but the recent development of lower mortgage rates coupled with increasing inventory is a powerful combination that will provide the environment for sales to move higher in future months,” predicts Lawrence Yun, chief economist at National Association of Realtors, which publishes the data.

Philadelphia Fed Manufacturing Index reflects a return to growth in September. The slightly positive reading for this month marks a rebound from a weak reading in August.

The US stock market rose to a record high on Thursday, based on the S&P 500 Index. “This rally feels like a bit of a sugar rush, but the longer and further that it persists, the more lasting it seems,” opines Steve Sosnick, chief strategist at Interactive Brokers.

Author: James Picerno