Macro Briefing: 22 April 2025

“If this were to happen, then the reserve status of the dollar, and haven value of Treasuries, would be wiped out—probably permanently in both cases…” Uncertainty about US policymaking has triggered a flight out of the US dollar and Treasurys… The US Dollar Index has with the dollar index…

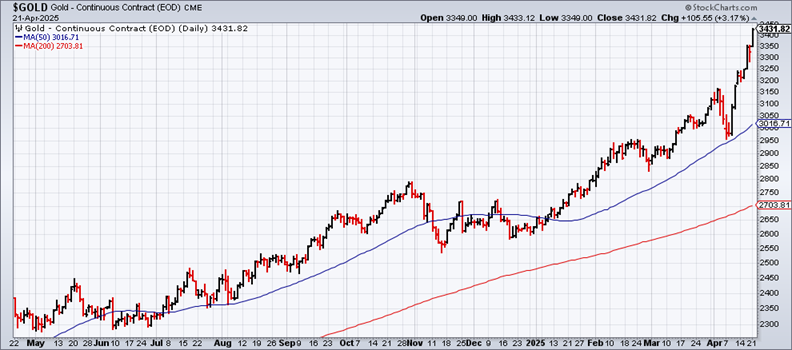

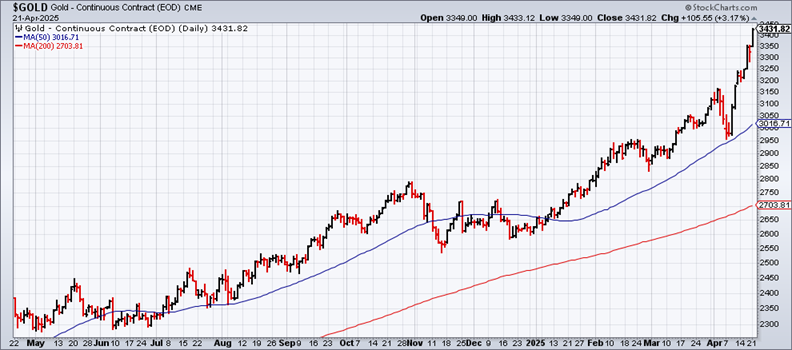

Gold surged to another record high in Monday’s trading, closing near $3,432 an ounce, and in early trading today it reached $3,500. “As tariff tensions continue to move at a fevered pitch, we continue to see gold prices move to the upside as a safe haven response,” said David Meger, director of metals trading at High Ridge Futures.

Trump on Monday renewed attacks on Federal Reserve Chairman Powell, pressuring the central bank to cut interest rates. “There can almost be no inflation, but there can be a SLOWING of the economy unless Mr Too Late, a major loser, lowers interest rates, NOW,” the president wrote on social media. The political pressure on the Fed is raising alarms that the central bank’s independence for setting monetary policy is under threat. “Were Powell to be fired, the initial reaction would be a huge injection of volatility into financial markets, and the most dramatic rush to the exit from US assets that it is possible to imagine,” wrote Michael Brown, senior research strategist at Pepperstone in London. “If this were to happen, then the reserve status of the dollar, and haven value of Treasuries, would be wiped out—probably permanently in both cases.”

Uncertainty about US policymaking has triggered a flight out of the US dollar and Treasurys. The US Dollar Index has with the dollar index weakening more than 9% so far this year. Bank of America’s latest Global Fund Manager Survey finds a net 61% of participants expect the dollar to weaken over the next 12 months — the most bearish outlook of major investors in nearly two decades.

The Republican leader of a congressional task force focused on the Federal Reserve says there is bipartisan support for stronger guardrails around the central bank’s independence. “From my perspective, the challenge is how do you keep my friends in Congress and other political forces around from impeding price stability and impeding the focus of the Fed,” said Rep. Frank Lucas (R-Ok.). “Independence matters to me.”

Apollo Global Management’s chief economist says a US recession is virtually assured if tariffs remain intact. “It’s all conditioned on tariffs staying in place at these levels, and if they stay at these levels, we will absolutely have a recession in 2025,” Torsten Slok told CNBC on Monday.

The US Leading Economic fell again in March, pointing to “slowing economic activity ahead,” said a spokesperson at The Conference Board. “March’s decline was concentrated among three components that weakened amid soaring economic uncertainty ahead of pending tariff announcements: 1) consumer expectations dropped further, 2) stock prices recorded their largest monthly decline since September 2022, and 3) new orders in manufacturing softened. That said, the data does not suggest that a recession has begun or is about to start.”

Author: James Picerno

Macro Briefing: 22 April 2025

“If this were to happen, then the reserve status of the dollar, and haven value of Treasuries, would be wiped out—probably permanently in both cases…” Uncertainty about US policymaking has triggered a flight out of the US dollar and Treasurys… The US Dollar Index has with the dollar index…

Gold surged to another record high in Monday’s trading, closing near $3,432 an ounce, and in early trading today it reached $3,500. “As tariff tensions continue to move at a fevered pitch, we continue to see gold prices move to the upside as a safe haven response,” said David Meger, director of metals trading at High Ridge Futures.

Trump on Monday renewed attacks on Federal Reserve Chairman Powell, pressuring the central bank to cut interest rates. “There can almost be no inflation, but there can be a SLOWING of the economy unless Mr Too Late, a major loser, lowers interest rates, NOW,” the president wrote on social media. The political pressure on the Fed is raising alarms that the central bank’s independence for setting monetary policy is under threat. “Were Powell to be fired, the initial reaction would be a huge injection of volatility into financial markets, and the most dramatic rush to the exit from US assets that it is possible to imagine,” wrote Michael Brown, senior research strategist at Pepperstone in London. “If this were to happen, then the reserve status of the dollar, and haven value of Treasuries, would be wiped out—probably permanently in both cases.”

Uncertainty about US policymaking has triggered a flight out of the US dollar and Treasurys. The US Dollar Index has with the dollar index weakening more than 9% so far this year. Bank of America’s latest Global Fund Manager Survey finds a net 61% of participants expect the dollar to weaken over the next 12 months — the most bearish outlook of major investors in nearly two decades.

The Republican leader of a congressional task force focused on the Federal Reserve says there is bipartisan support for stronger guardrails around the central bank’s independence. “From my perspective, the challenge is how do you keep my friends in Congress and other political forces around from impeding price stability and impeding the focus of the Fed,” said Rep. Frank Lucas (R-Ok.). “Independence matters to me.”

Apollo Global Management’s chief economist says a US recession is virtually assured if tariffs remain intact. “It’s all conditioned on tariffs staying in place at these levels, and if they stay at these levels, we will absolutely have a recession in 2025,” Torsten Slok told CNBC on Monday.

The US Leading Economic fell again in March, pointing to “slowing economic activity ahead,” said a spokesperson at The Conference Board. “March’s decline was concentrated among three components that weakened amid soaring economic uncertainty ahead of pending tariff announcements: 1) consumer expectations dropped further, 2) stock prices recorded their largest monthly decline since September 2022, and 3) new orders in manufacturing softened. That said, the data does not suggest that a recession has begun or is about to start.”

Author: James Picerno