Macro Briefing: 22 August 2025

Fed minutes reflected a diversity of opinion on the outlook for inflation and economic growth… “Participants generally pointed to risks to both sides of the Committee’s dual mandate, emphasizing upside risk to inflation and downside risk to employment,” according to the minutes from the l…

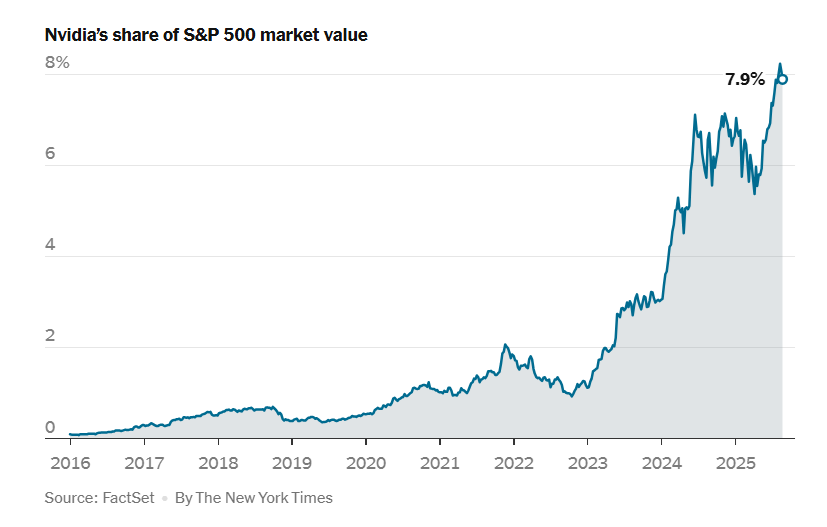

Chipmaker Nvidia’s earnings report next week could be a major factor for market sentiment. “On a relative basis, Nvidia’s earnings is the largest event for the S&P 500 for the next month,” said Stuart Kaiser, an equity strategist at Citi. Nvidia’s share of the S&P 500’s market value has surged in recent years and is currently around 8%.

Fed minutes reflected a diversity of opinion on the outlook for inflation and economic growth. “Participants generally pointed to risks to both sides of the Committee’s dual mandate, emphasizing upside risk to inflation and downside risk to employment,” according to the minutes from the last FOMC meeting.

Fed Chairman Powell’s speech tomorrow faces delicate balancing act as the central bank attempts to adjust monetary policy amid concerns of tariff inflation vs. signs of slowing growth. “You have this political pressure balanced off against the economic pressure, which makes Powell’s job particularly difficult, and it’s driving a hyper-focus on what he might say on Friday,” said Melissa Brown, managing director of investment decision research at SimCorp.

Fed Governor Lisa Cooks announced she will not step down following accusations from the Trump administration that she committed mortgage fraud. “I have no intention of being bullied to step down from my position because of some questions raised in a tweet,” she said in a statement.

US 10-year Treasury yield continues to trade in middling range vs. recent history going into today’s start of the Federal Reserve’s annual meeting. The benchmark rate ended Wednesday’s session at 4.30%.

Author: James Picerno