Macro Briefing: 22 August 2025

“A strong flash PMI reading for August adds to signs that US businesses have enjoyed a strong third quarter so far,” says Chris Williamson, chief business economist at S&P Global Market Intelligence…US business activity accelerated in August, growing at the fastest rate of the year, accor…

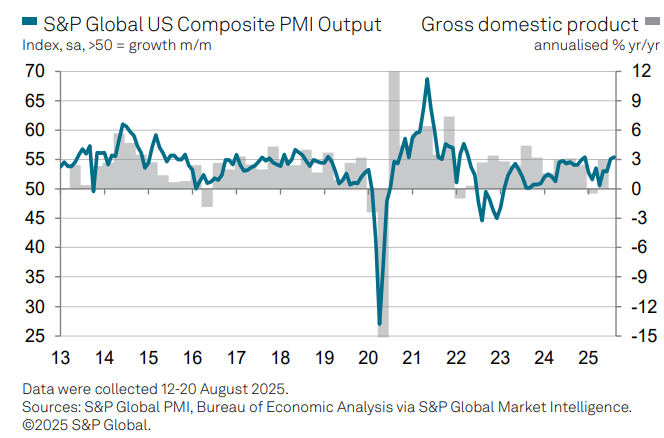

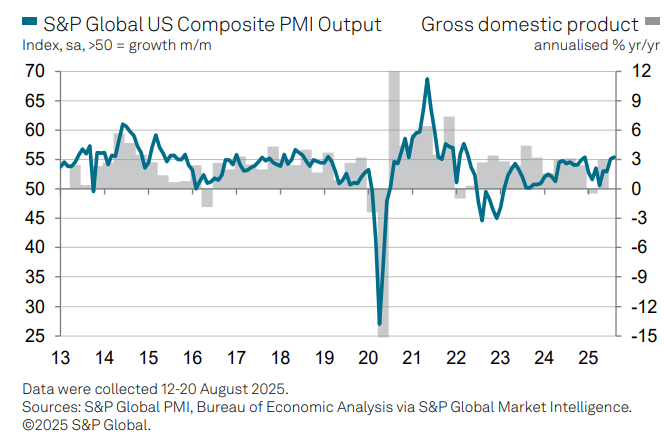

US business activity accelerated in August, growing at the fastest rate of the year, according to the Composite PMI Output Index, a survey-based GDP proxy. “A strong flash PMI reading for August adds to signs that US businesses have enjoyed a strong third quarter so far,” says Chris Williamson, chief business economist at S&P Global Market Intelligence.

US initial jobless claims rose last week to the highest level since mid-June. “The latest rise in claims, if sustained, would indicate some pickup in layoffs, albeit from very low levels,” wrote Nancy Vanden Houten, lead US economist at Oxford Economics, in a note.

US existing-home sales rose 2.0% in July. “The ever-so-slight improvement in housing affordability is inching up home sales,” said NAR Chief Economist Lawrence Yun.

The US Leading Economic Indicator edged lower in July. “Pessimistic consumer expectations for business conditions and weak new orders continued to weigh down the index,” said Justyna Zabinska-La Monica, senior manager for business cycle indicators at The Conference Board.

Market history suggests that various analytical techniques can provide a timely read on when a market has hit its low and a rebound has started or is near, advises TMC Research, a unit of The Milwaukee Company. Although evaluating the outlook for markets is always risky, quantitatively evaluating relatively severe declines can be helpful for developing calculated risk estimates and deciding if opportunistically tilting portfolios is warranted.

Author: James Picerno