Macro Briefing: 22 January 2025

US GDP growth in next week’s fourth-quarter report from the government is expected to post a pickup to a strong 3… But the fact that a wide range of published economic data that’s used to generate the nowcast indicates a strong pace of growth for Q4 suggests that recession risk is low and US …

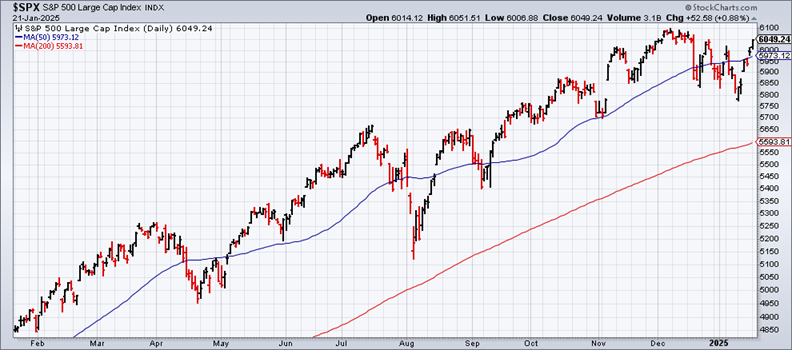

US equities rose for a second day, lifting the S&P 500 Index closer to its record-high close posted in December. “President Trump’s Inauguration Day policy announcements on tariffs were more benign than expected,” wrote Alec Phillips, chief US political economist at Goldman Sachs, in a note to clients yesterday. Jamie Cox, managing partner at Harris Financial Group, says the market “seems to have overcome its tariff tantrum.”

Trump says he’s considering a 10% tariff on China beginning for Feb. 1. “We’re talking about a tariff of 10% on China based on the fact that they’re sending fentanyl to Mexico and Canada,” the president said on Tuesday. “Probably Feb. 1 is the date we’re looking at.”

Trump highlights new joint venture investing up to $500 billion in AI, funded by a new partnership with OpenAI, Oracle and SoftBank. The Stargate project will start building data centers and the electricity generation needed at a site in Texas, according to the White House. The initial investment is expected to be $100 billion.

Trump signs executive order that ends Biden-era electric vehicle targets. The order revokes unspent government funds for EV charging stations and ends a waiver allowing states to ban internal-combustion cars by 2035.

The US Securities and Exchange Commission will launch a cryptocurrency-focused task force to formulate ways to regulate the market. Acting SEC Chair Mark Uyeda says the task force will be dedicated to developing a “comprehensive and clear” regulatory framework for crypto assets.

US GDP growth in next week’s fourth-quarter report from the government is expected to post a pickup to a strong 3.6% increase, according to a revised nowcast published by TMC Research, a division of The Milwaukee Company, a wealth manager: “The sharp upward revision from the previous estimate on Dec. 10 should be viewed cautiously. As always with nowcasts and forecasts, there’s a wide range of uncertainty around the point estimate. But the fact that a wide range of published economic data that’s used to generate the nowcast indicates a strong pace of growth for Q4 suggests that recession risk is low and US output ended 2024 with a vigorous tailwind.”

Author: James Picerno