Macro Briefing: 22 May 2025

“It goes without saying that if Trump is, in fact, looking to the Treasury market as a barometer of investors’ approval of the action in Washington [with regards to the current debate over the federal spending bill], then the recent sell-off that brought 30-year yields from as low as 4… Stock…

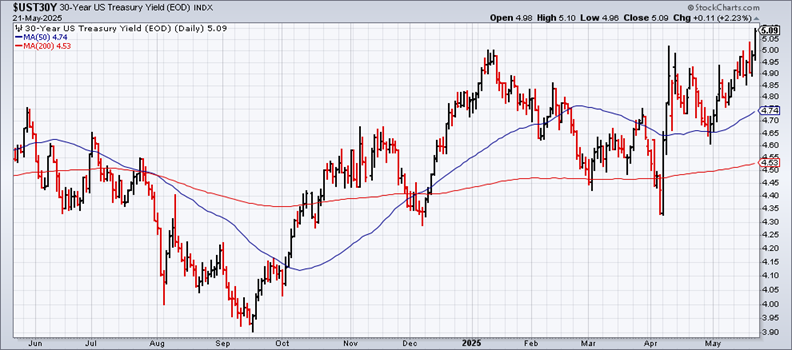

US 30-year Treasury yield jumps to 5.09%, the highest level since late-2023. “It goes without saying that if Trump is, in fact, looking to the Treasury market as a barometer of investors’ approval of the action in Washington [with regards to the current debate over the federal spending bill], then the recent sell-off that brought 30-year yields from as low as 4.65% earlier this month to 5.095% is without question a troubling development,” said Ian Lyngen, an interest rate strategist at BMO Capital Markets.

Bitcoin rose to a new record high on Wednesday. “Bitcoin’s new high has been concocted by an array of favorable ingredients in the macro cauldron, namely softer U.S. inflation numbers, a de-escalation in the U.S.-China trade war and the Moody’s downgrade of U.S. sovereign debt, which has put the spotlight on alternative stores of value like bitcoin,” said Antoni Trenchev, cofounder of crypto exchange Nexo.

Trump considers selling Freddie Mac and Fannie Mae, the government-run housing finance entities. “I am giving very serious consideration to bringing Fannie Mae and Freddie Mac public,” Trump wrote on social media on Wednesday.

Retail giants are unsure how to react to higher US tariffs. Zacks Investment Research analyst Sheraz Mian said he doubts that Target will be able to fully absorb the tariffs. “They don’t want to publicly acknowledge it and get into the unfavorable kind of political limelight by speaking the truth.” Axios also reports: “Walmart, the world’s largest retailer, said last week it couldn’t hold the line anymore and would have to raise some prices.

Target said it would “offset the vast majority” of tariff impacts to consumers and remain “price competitive.”

Demand for mortgages drops after interest rates jump to the highest level since February. “Mortgage rates jumped to their highest level since February last week, with investors concerned about rising inflation and the impact of increasing deficits and debt,” said Mike Fratantoni, senior vice president and chief economist at the MBA.

Stocks in emerging markets (VWO) are in the spotlight as the “sell US” narrative resonates. The Bank of America recently predicted that emerging markets are “the next bull market.” The bank’s investment strategist Michael Hartnett and his team wrote in a note to clients: “Weaker U.S. dollar, U.S. bond yield top, China economic recovery…nothing will work better than emerging market stocks.”

Author: James Picerno