Macro Briefing: 22 October 2024

The high 13% average annual performance over the past decade will dwindle to a weak 3% for the decade ahead, analysts at the firm predict… Goldman analysts warn that such a high dependence on a handful of companies leaves the S&P 500 vulnerable to earnings growth for those firms… “Our his…

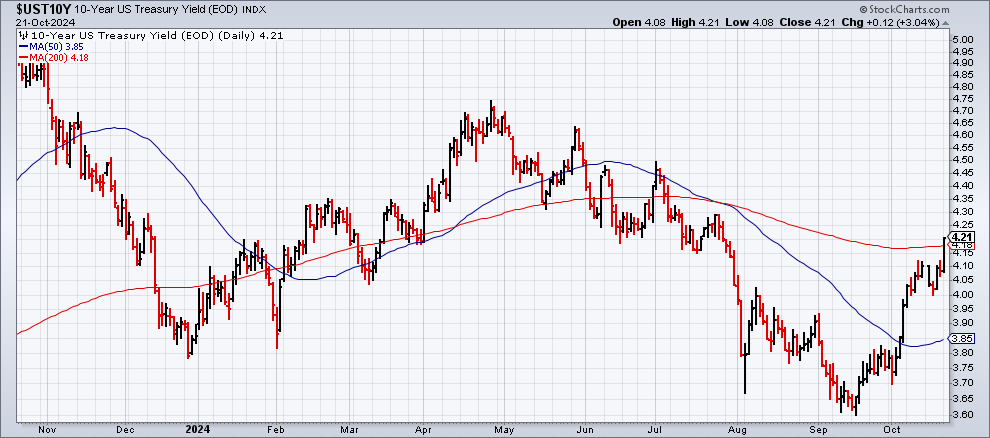

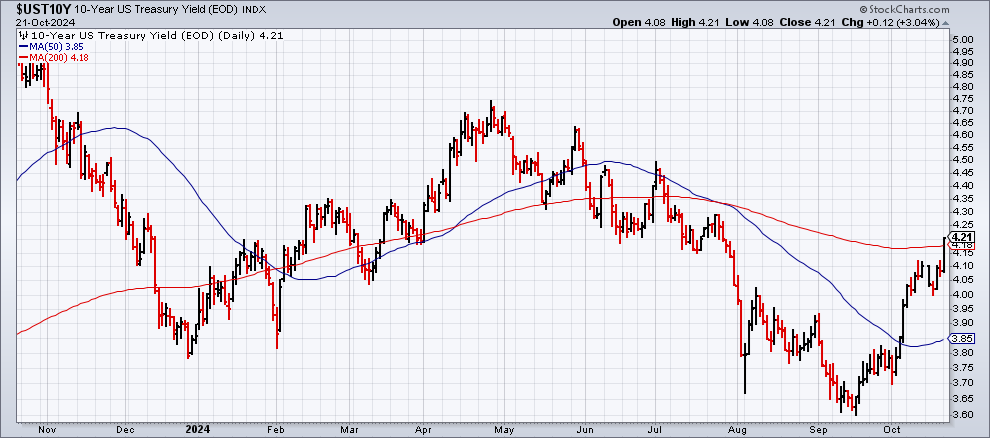

US 10-year Treasury yield rises to 4.21%, highest level since late-July. “With less than two weeks now until the US elections, concerns about the fiscal outlook and its potential upward pressure on inflation have become more acute,” says Robert Dishner, senior portfolio manager at Neuberger Berman.

Goldman Sachs forecasts a sharply lower return for the S&P 500 over the next ten years. The high 13% average annual performance over the past decade will dwindle to a weak 3% for the decade ahead, analysts at the firm predict. A key driver for the dramatically softer performance outlook is extreme concentration in the benchmark’s holdings, which is close to highest level in a century. Goldman analysts warn that such a high dependence on a handful of companies leaves the S&P 500 vulnerable to earnings growth for those firms. “Our historical analyses show that it is extremely difficult for any firm to maintain high levels of sales growth and profit margins over sustained periods of time,” the analysts write.

After gold’s recent bull run, a “new bullish phase” is brewing, predicts Paul Wong, market strategist at Sprott Asset Management. “Gold has entered a new bullish phase, driven by factors like central bank buying, rising U.S. debt and a potential peak in the U.S. dollar,” he writes in a note this week. “Rising U.S. debt-to-GDP ratios have historically led to higher gold prices due to concerns over the sustainability of debt, currency devaluation and debt monetization.” UBS analyst Giovanni Staunovo says: “We look for gold to reach to $2,900/oz over the next 12 months, supported by further rate cuts by the Fed.”

Three Federal Reserve officials on Monday predict the central bank will continue to lower interest rates. A “cautious and gradual” is recommended, says Kansas City Fed president Jeff Schmid. Minneapolis Fed president Neel Kashkari anticipates “modest cuts over the next quarters.” And Dallas Fed president Lorie Logan repeats her outlook that rates will fall “gradually,” noting that there’s a risk the job market could weaken and inflation could revive.

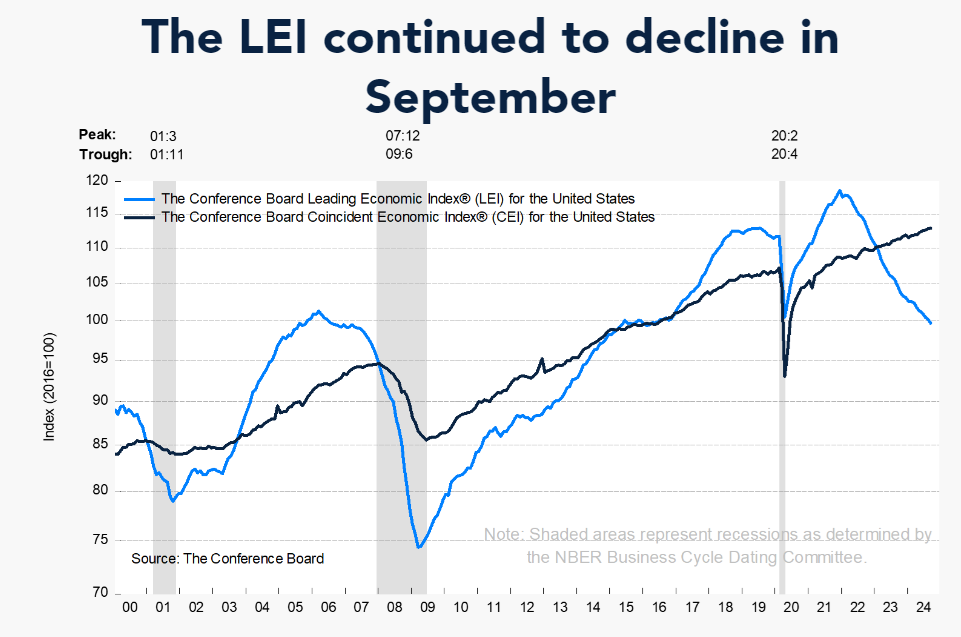

The Conference Board’s Leading Economic Index continued to slide in September. The decline is approaching its third straight year of weakness after peaking in December 2021. “Weakness in factory new orders continued to be a major drag on the US LEI in September as the global manufacturing slump persists,” says Justyna Zabinska-La Monica, senior manager, business cycle indicators, at The Conference Board.

Author: James Picerno