Macro Briefing: 24 April 2024

* Fed likely to err on hawkish side of fewer rate cuts: Former Fed Vice Chair Clarida * China may face new wave of bond defaults, predicts S&P Global Ratings * Ether ETFs unlikely to receive US approval in May: Standard Charter * New US home sales surged in March despite high mortgage rates * US…

* Fed likely to err on hawkish side of fewer rate cuts: Former Fed Vice Chair Clarida

* China may face new wave of bond defaults, predicts S&P Global Ratings

* Ether ETFs unlikely to receive US approval in May: Standard Charter

* New US home sales surged in March despite high mortgage rates

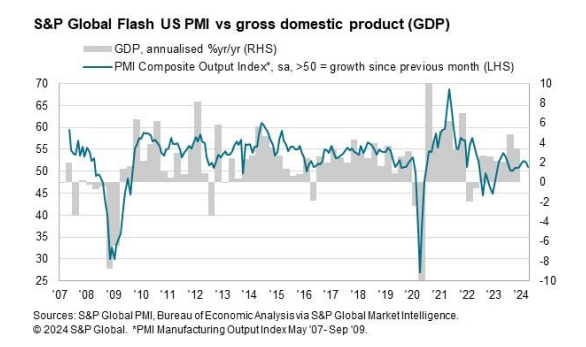

* US economic activity slows to 4-month low in April: PMI survey data:

Correlation between US stocks and bonds has risen sharply recently, based on a rolling 3-year window, Morningstar reports. Reviewing the historical record, “The most acute spikes in correlation happened during concentrated periods of interest-rate stress,” writes Amy C. Arnott, an analyst at the consultancy. “When the market expects borrowing costs to climb, correlations between stocks and bonds typically increase.”

Author: James Picerno