Macro Briefing: 24 June 2024

* US stock market in longest run without 2% correction since financial crisis * China and EU will hold talks on tariffs for electric vehicles * Existing home sales decline for third straight month * US Leading Economic Index fell again in May * US existing home sales fall for 3rd month as prices rea…

* US stock market in longest run without 2% correction since financial crisis

* China and EU will hold talks on tariffs for electric vehicles

* Existing home sales decline for third straight month

* US Leading Economic Index fell again in May

* US existing home sales fall for 3rd month as prices reach record high

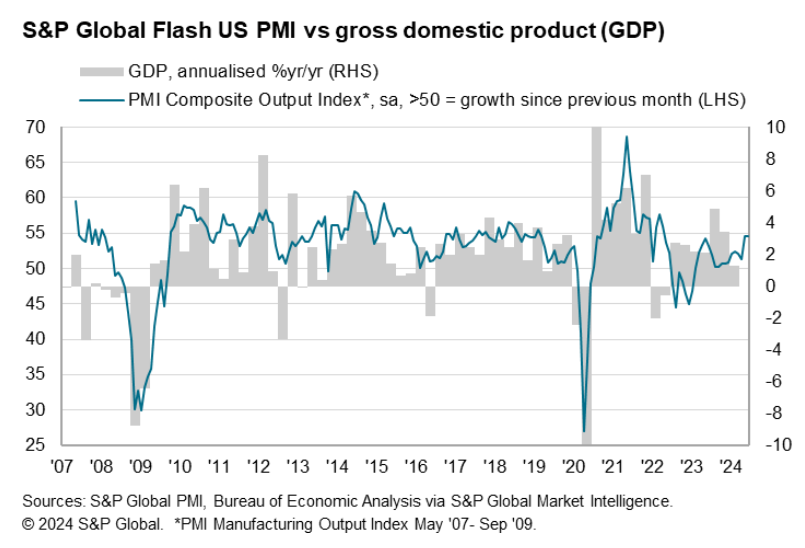

* US business activity growth rises in June to a 26-mo high via PMI survey:

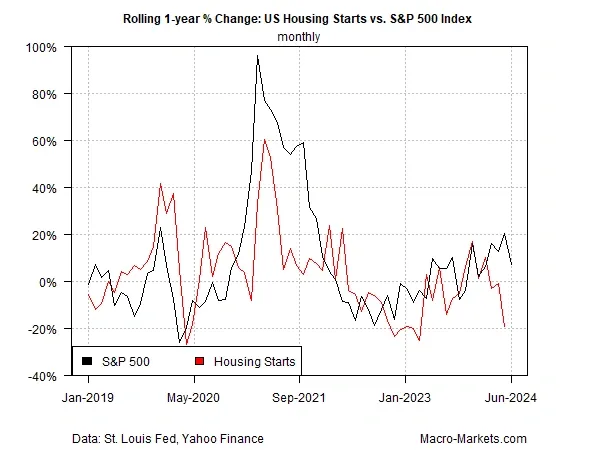

The relatively tight correlation between the US stock market and residential housing construction is fading, observes a new research note from TMC Research, a division of The Milwaukee Company, a wealth manager. Historically, weak housing activity has been associated with recessions and bear markets, but so far in 2024 the relationship appears to be breaking down. Notably, the S&P 500 in recent months has continued to rally despite the sharp slide in housing starts. In May, new residential construction activity fell to the lowest level in four years. The chart below compares the rolling one-year change for stocks vs. starts, highlighting the recent divergence.

Author: James Picerno