Macro Briefing: 24 September 2024

The services sector is the main driver, posting a “solid pace” of growth, reports S&P Global Market Intelligence… By contrast, the manufacturing sector’s output fell for a second month… “The early survey indicators for September point to an economy that continues to grow at a solid …

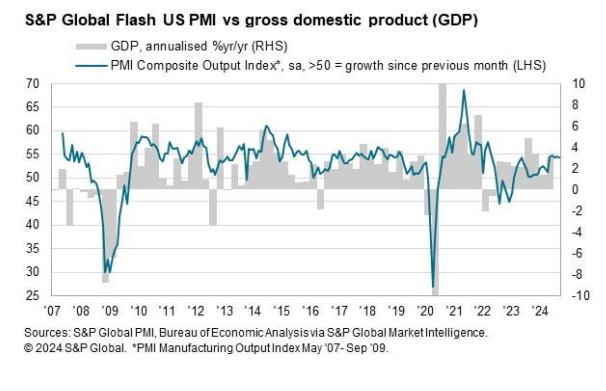

US business activity remains “robust” in September, according to the Composite PMI, a GDP proxy. The services sector is the main driver, posting a “solid pace” of growth, reports S&P Global Market Intelligence. By contrast, the manufacturing sector’s output fell for a second month. “The early survey indicators for September point to an economy that continues to grow at a solid pace, albeit with a weakened manufacturing sector and intensifying political uncertainty acting as substantial headwinds,” writes Chris Williamson, chief business economist at S&P Global.

The Chicago Fed National Fed Activity Index rebounded in August to an above-trend reading. The modestly firmer reading for last month marks the highest level since May.

Israeli airstrikes continue to pound southern Lebanon, marking deadliest day of conflict since the war between the two countries in 2006. “I can say that we are almost in a full-fledged war,” says European Union foreign policy chief Josep Borrell. “If this is not a war situation, I don’t know what you would call it.”

China announces stimulus package to boost economy. The central bank’s governor outlined a broad package of measures intended to strengthen the country’s slowing economy.

Stocks in emerging markets rose on Monday (Sep. 23) to the highest close in 2-1/2 years, based on Vanguard Emering Markets ETF (VWO). The rebound marks a recovery that’s been relatively persistent since the start of the year.

Author: James Picerno