Macro Briefing: 26 August 2024

* Oil prices expected to remain elevated amid risk of wider Middle East war * US 10yr yield falls to 3.80% after Fed’s Powell talks of rate cuts * Gold holds near record high after Powell’s dovish policy comments * German business sentiment falls for third consecutive month in August * US new ho…

* Oil prices expected to remain elevated amid risk of wider Middle East war

* US 10yr yield falls to 3.80% after Fed’s Powell talks of rate cuts

* Gold holds near record high after Powell’s dovish policy comments

* German business sentiment falls for third consecutive month in August

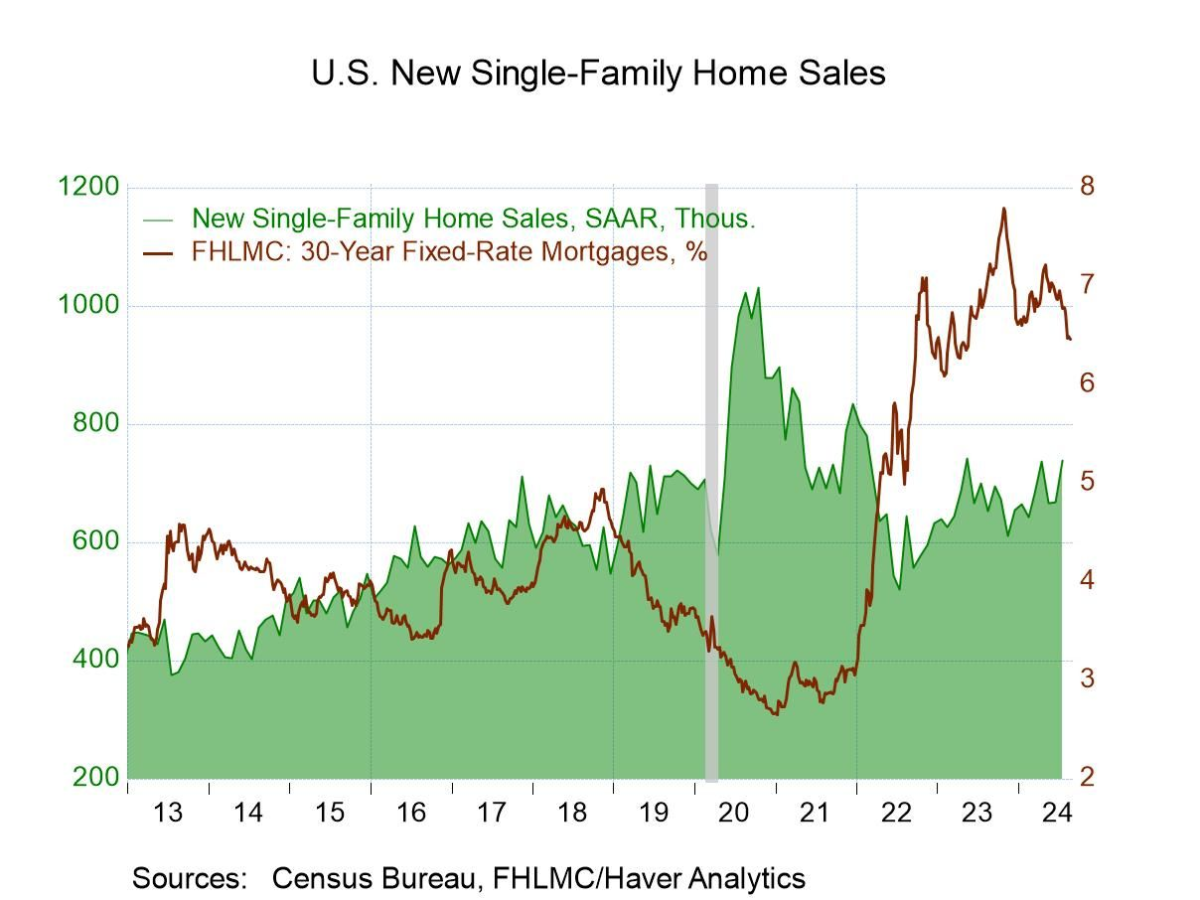

* US new home sales in July rise to highest level in over a year:

Rising federal debt will likely constrain policy options for the next US president, advises a new research note from TMC Research, a division of The Milwaukee Company: “The debt burden has increased over the years, with a spike during 2020 when pandemic-related spending surged. The burden has eased in the last three years, but the current percentage – 122% as of 2024’s first quarter – remains far above the percentage that prevailed pre-pandemic.”

Author: James Picerno