Macro Briefing: 26 July 2024

* Big-tech rally at risk if US economy cools, predicts Bank of America analyst * US credit card delinquency rates rise to 12-year high * Durable goods orders for US post surprisingly large decline in June * Apple falls out of top-5 smartphone vendors in China * US jobless claims fell last week, hold…

* Big-tech rally at risk if US economy cools, predicts Bank of America analyst

* US credit card delinquency rates rise to 12-year high

* Durable goods orders for US post surprisingly large decline in June

* Apple falls out of top-5 smartphone vendors in China

* US jobless claims fell last week, holding in relatively low range

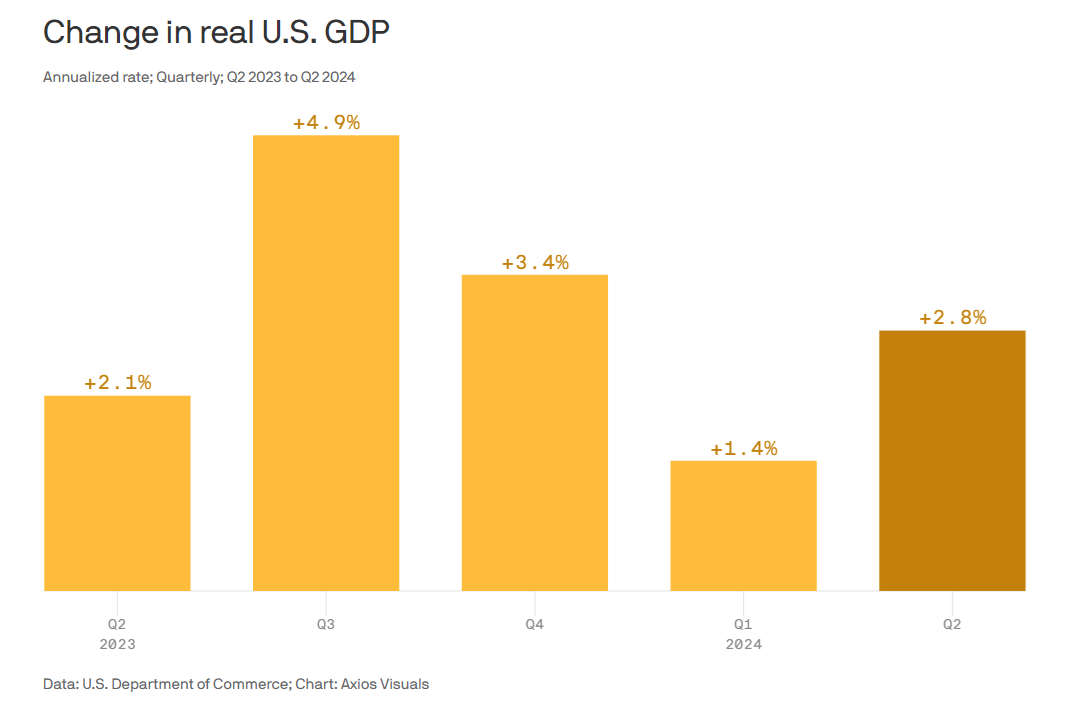

* US economic growth rises more than expected in Q2:

Fed funds futures continue to price in a high probability of a September rate cut after a stronger-than-expected US GDP report for the second quarter. The market this morning estimates a roughly 90% probability that the Fed will cut rates at the Sep. 18 FOMC meeting. That’s down modestly from the pre-GDP release, but it continues to reflect confidence of easing in the near future.

Author: James Picerno