Macro Briefing: 27 June 2025

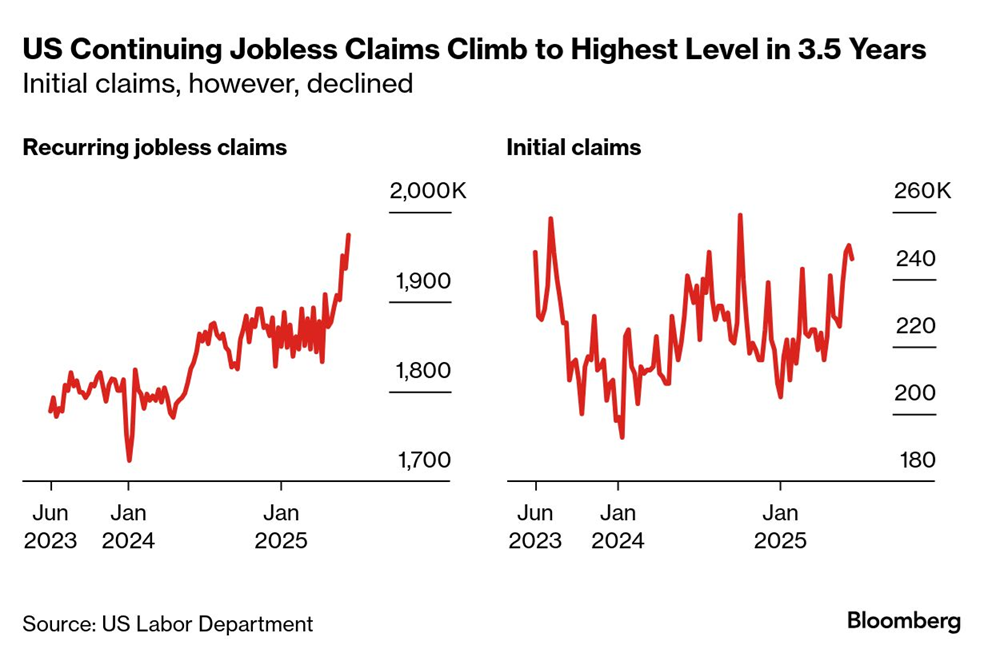

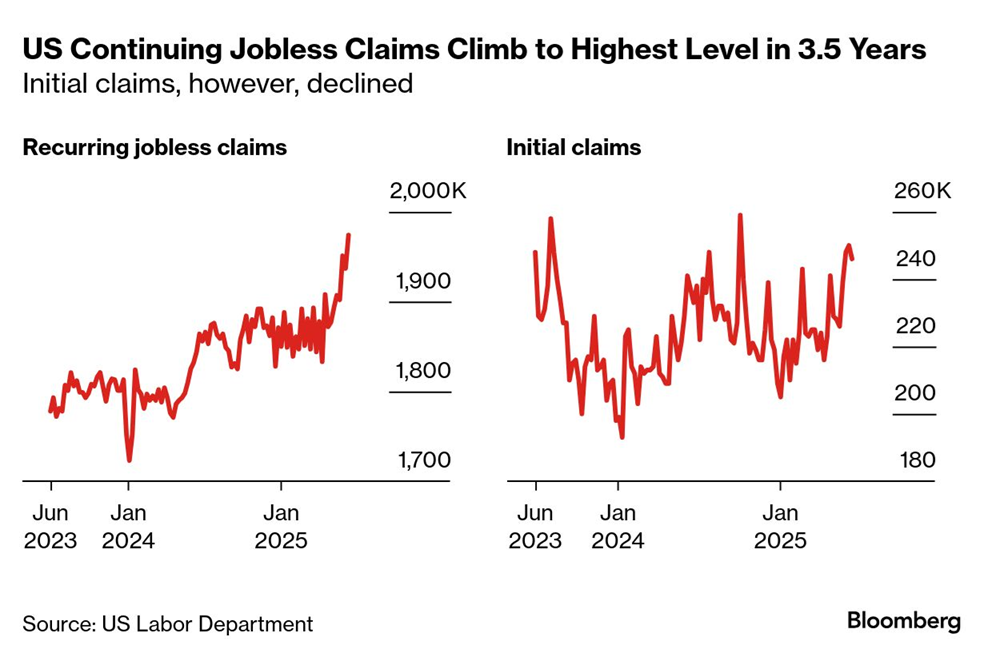

US initial jobless claims pulled back last week as continuing claims continued rising… The number of Americans collecting unemployment insurance on a recurring basis rose to the highest level in 3-1/2 years — a possible warning sign for the labor market… “The data are consistent with softeni…

US initial jobless claims pulled back last week as continuing claims continued rising. The number of Americans collecting unemployment insurance on a recurring basis rose to the highest level in 3-1/2 years — a possible warning sign for the labor market. “The data are consistent with softening of labor market conditions, particularly on the hiring side of the labor market equation,” said Nancy Vanden Houten, lead economist at Oxford Economics. “For now, we don’t think the labor market is weak enough to prompt the Fed to cut rates before December, but the risk is increasing that once the Fed starts to lower rates, it will have some catching up to do.”

Revised GDP data for the first quarter show that the US economy shrank more than previously estimated. Output fell 0.5% in Q1 vs. the 0.1% for the earlier estimate, according to the Bureau of Economic Analysis.

The US trade deficit increased 11% in May as exports decreased and imports remained relatively unchanged, the Commerce Department’s Census Bureau reported. The slide in US exports was sharp, falling in May at the steepest rate since the coronavirus crisis in 2020.

The Chicago Fed National Activity Index picked up in May, but the current reading still shows a below-trend profile for the US economy. Two of the four broad categories of signals used to construct the economic activity gauge increased sequentially last month, though three categories made negative contributions over the same period.

China said it would approve the export of rare earth minerals to the US. Earlier, White House officials said the two sides had reached a deal. The agreements marks major breakthrough after weeks of negotiations over US access to the key materials produced in China.

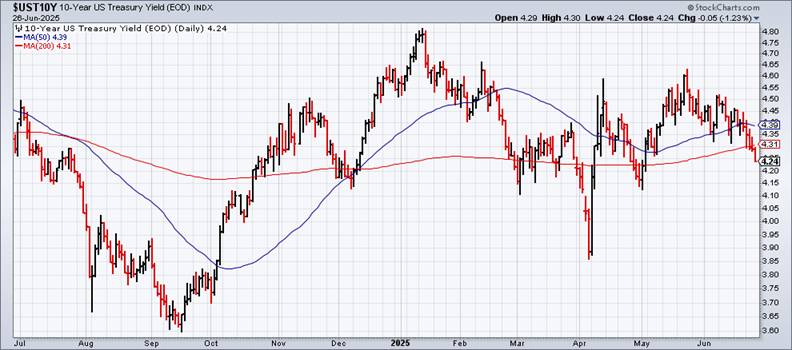

US 10-year Treasury yield falls to 4.24%, lowest in nearly two months. Fed funds futures are pricing in a roughly 90% probability that the central bank will start cutting rates in September.

Author: James Picerno