Macro Briefing: 28 August 2024

TutoSartup excerpt from this article:

* US home prices rose 5.4% in June vs year-ago level–faster than inflation * AI bellwether Nvidia set to report earnings today after closing bell * Across-the-board tariffs for US may be coming. Here’s what to expect * 3 contrarian strategies worth a fresh look: EM stocks, value and small caps *…

Macro Briefing: 28 August 2024

Author: James Picerno

* US home prices rose 5.4% in June vs year-ago level–faster than inflation * AI bellwether Nvidia set to report earnings today after closing bell * Across-the-board tariffs for US may be coming. Here’s what to expect * 3 contrarian strategies worth a fresh look: EM stocks, value and small caps *…

* US home prices rose 5.4% in June vs year-ago level–faster than inflation

* AI bellwether Nvidia set to report earnings today after closing bell

* Across-the-board tariffs for US may be coming. Here’s what to expect

* 3 contrarian strategies worth a fresh look: EM stocks, value and small caps

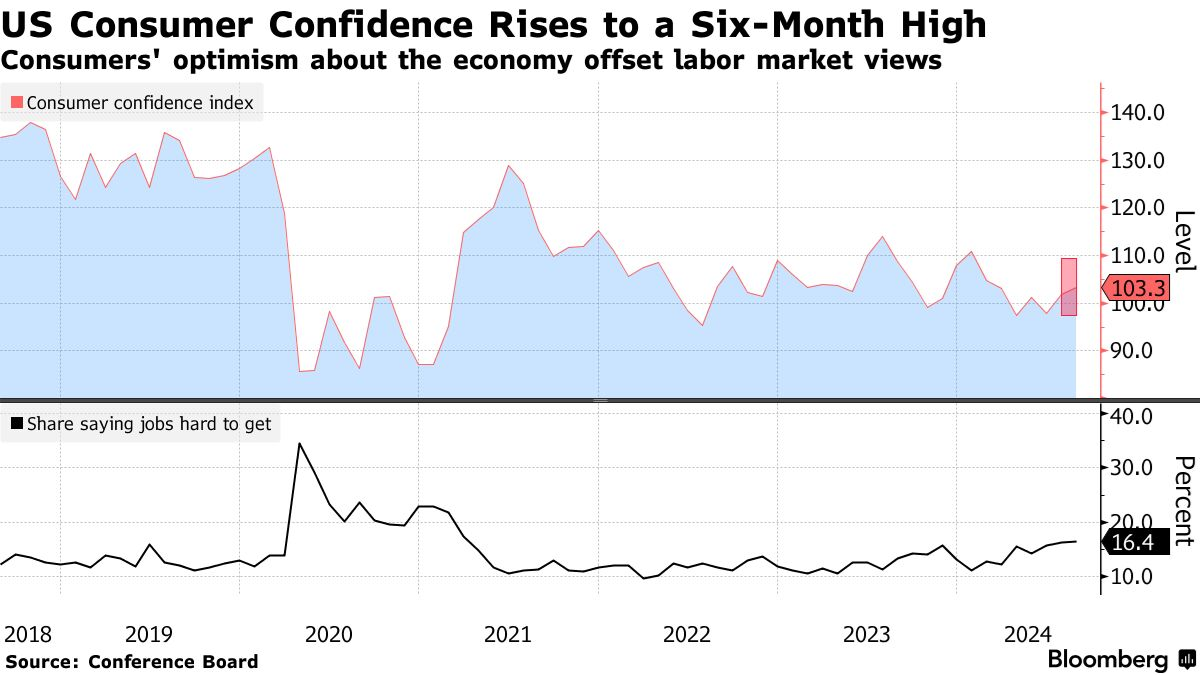

* US consumer confidence rises to a six-month high in August:

Tech stocks continue to underperform the broad US equities market year to date, based on a pair of ETFs. After the late-July correction in shares overall, Technology Select Sector SPDR Fund (XLK) lost its edge over SPDR S&P 500 (SPY). XLK is currently up this year by 16.0%, comfortably behind SPY’s 18.9% advance through Tuesday’s close (Aug. 27).

Author: James Picerno