Macro Briefing: 28 May 2024

* US stock market was far more concentrated in the 1950s and 1960s vs today * Global debt nears 100% of global GDP–highest since the Napoleonic Wars * European Central Bank signals it’s likely to cut interest rates on June 6 * China is a tough act to match in the West for achieving parity in man…

* US stock market was far more concentrated in the 1950s and 1960s vs today

* Global debt nears 100% of global GDP–highest since the Napoleonic Wars

* European Central Bank signals it’s likely to cut interest rates on June 6

* China is a tough act to match in the West for achieving parity in manufacturing

* Fed’s Kashkari wants ‘many more months’ of good inflation data before rate cut

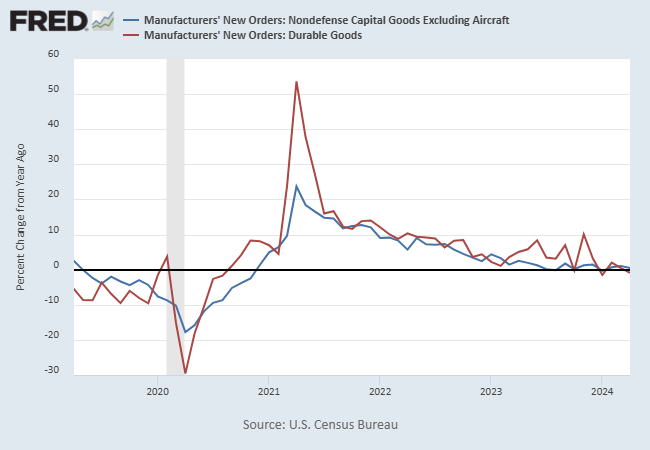

* US durable goods orders stagnate for 1-year trend through April:

The debate about the relevance of the US Treasury yield curve as a recession-forecasting tool persists as the indicator’s warning continues to look wrong. “If a recession doesn’t materialize soon, it could do lasting damage to the yield curve’s status as a warning system, providing one of the most significant examples of how the fallout from the Covid-19 pandemic has upended longstanding assumptions on Wall Street about how markets and the economy function,” advises The Wall Street Journal. “Even if the past couple of years have been unusual, investors likely wouldn’t be as worried when another inversion occurs in the future.”

“It’s not working,” says Ed Hyman, chairman of Evercore ISI. “So far, the economy is doing fine,” though he adds that it’s possible a recession is late this time.

Author: James Picerno