Macro Briefing: 28 October 2024

US consumer sentiment strengthened for a third straight month in October, according to survey data published by the University of Michigan… The school’s widely-read sentiment index edged higher this month to its highest reading since April… “This month’s increase was primarily due to modes…

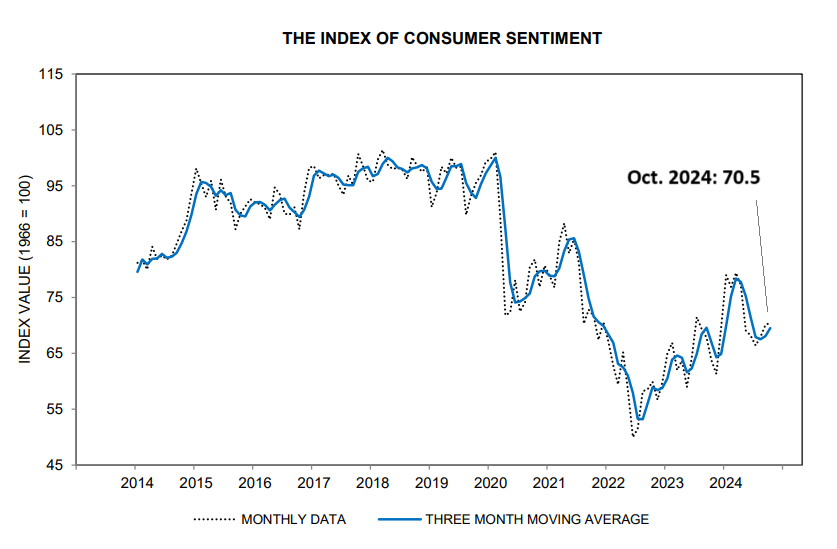

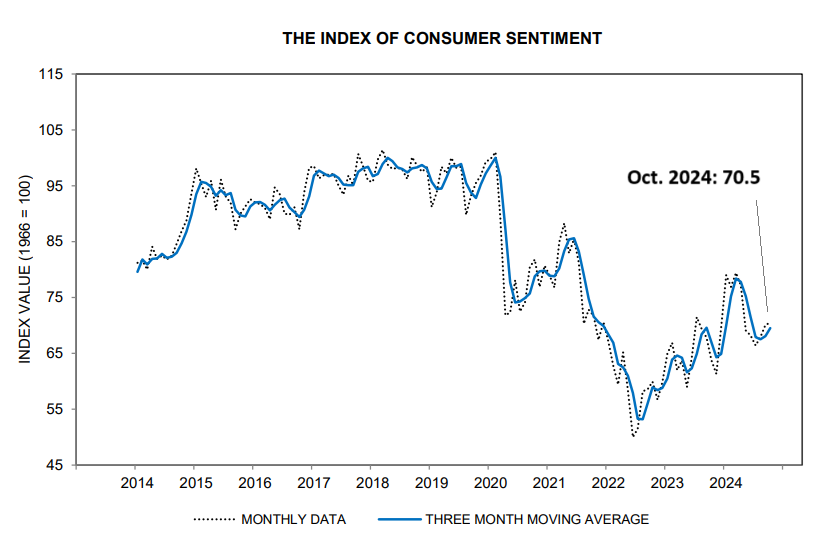

US consumer sentiment strengthened for a third straight month in October, according to survey data published by the University of Michigan. The school’s widely-read sentiment index edged higher this month to its highest reading since April. “This month’s increase was primarily due to modest improvements in buying conditions for durables, in part due to easing interest rates,” reports Joanne Hsu, surveys of consumers director at the university.

Durable goods orders in the US fell for a second month in September. A key factor in the the 0.8% decline last month is the two-months-old Boeing strike. “Boeing is our airline industry, so the fact that you got one company that’s so, so dominant, that can drag things down,” says Ed Emmett, a fellow in energy and transportation policy at Rice University’s Baker Institute.

Companies in the S&P 500 Index are beating earnings estimates but at the lowest rate in nearly two years. With nearly one-third of data released for the current reporting season, roughly 75% of firms show profits for the July-through-September period that beat analysts’ expectations, according to data compiled by Bloomberg Intelligence. “The early S&P 500 stats are now pointing to a mildly disappointing reporting season so far,” says Lori Calvasina, a strategist at RBC Capital Markets. Considering the current degree of optimism in the market, “we remain on guard for another short-term pullback in US equities,” she writes in a note to clients.

China industrial profits fell at its fastest pace since the pandemic. “While there is divergence across sectors, the stress is particularly high in upstream materials and automobiles,” advises Gary Ng, senior economist at Natixis.

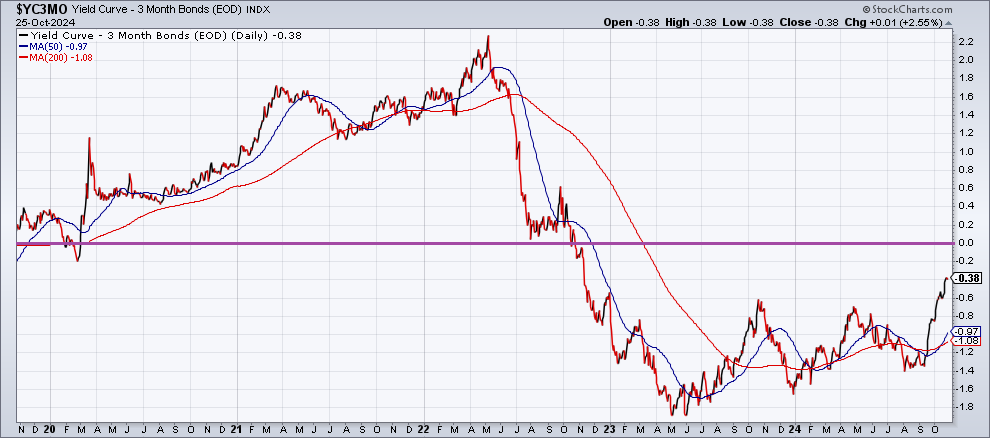

The 10-year/3-month US Treasury yield curve is close to un-inverting for the first time in two years. The spread on Friday was -38 basis points. The recent runup in the 10-year yield and the Fed’s rate cut in September have dramatically narrowed the negative spread in recent weeks.

Author: James Picerno