Macro Briefing: 29 July 2024

year-ago level:Small-cap stocks have outperformed large caps recently, but a clearer signal has yet to emerge that smaller firms will lead for an extended period, advises a research note from TMC Research, a division of The Milwaukee Company… Using a set of proxy ETFs for small caps (IJR) vs…..

* Reviewing the case that the Fed has waited too long to cut rates

* US manufacturers are rethinking hiring plans

* Foreclosures of distressed commercial properties surge

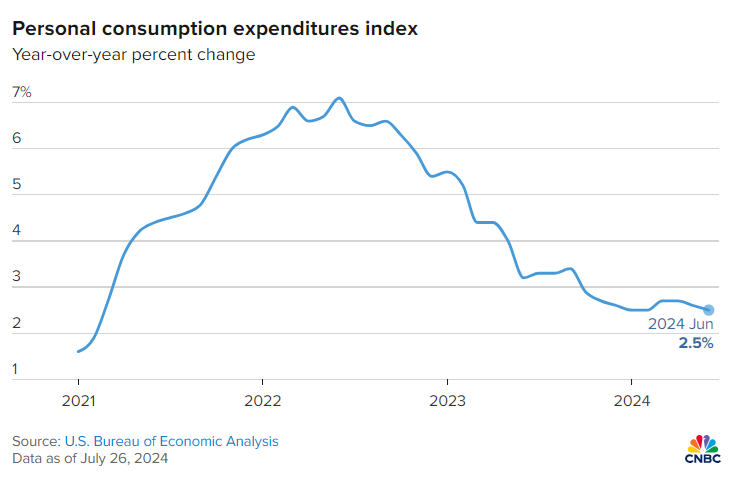

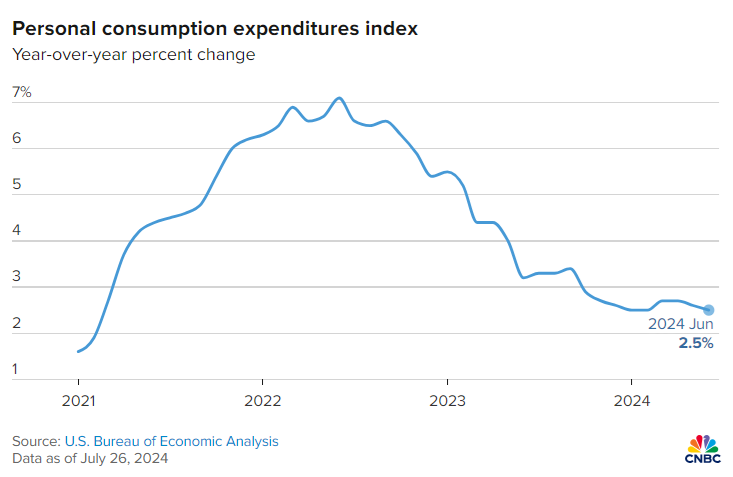

* A review of threats to the boom in artificial intelligence

* PCE inflation ticks down to 2.5% in June vs. year-ago level:

Small-cap stocks have outperformed large caps recently, but a clearer signal has yet to emerge that smaller firms will lead for an extended period, advises a research note from TMC Research, a division of The Milwaukee Company. Using a set of proxy ETFs for small caps (IJR) vs. large caps (SPY) shows that there have been three primary cycles since 2000. “There are hints that 2024 may be a turning point that marks the start of a new regime of small-cap outperformance. Over the past month, IJR has dramatically outperformed SPY: 11.5% vs. an essentially flat performance for SPY, through July 26. It’s too early to say if we’re in the early stages of a new extended period of small-cap leadership, but there are some encouraging clues. The first hurdle is whether the recent outperformance persists in the weeks ahead.”

Author: James Picerno