Macro Briefing: 29 October 2024

“If the economic data this week [especially Friday’s jobs report] is strong, then expectations for a November rate cut will fall, potentially hard, and that could inject some volatility into markets…Weather-related factors are expected to distort Friday’s jobs report… “The distortion…

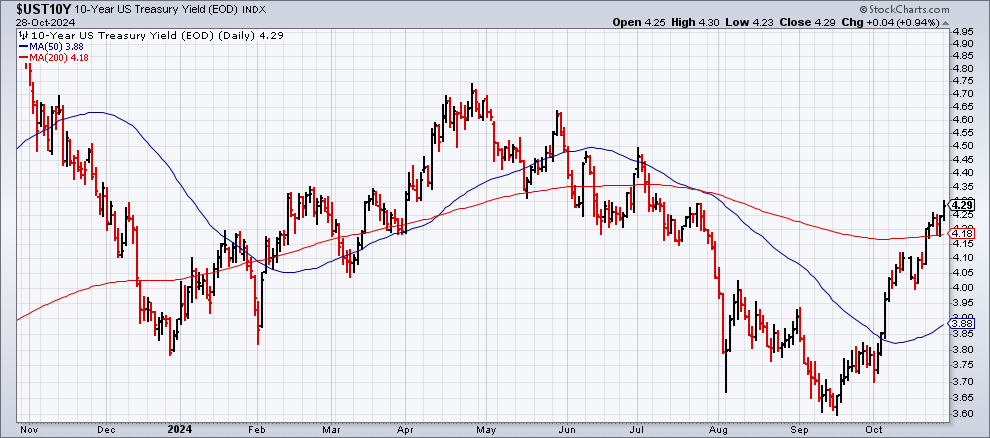

US 10-year Treasury yield rose to 4.29% on Monday, the highest since July. “If the economic data this week [especially Friday’s jobs report] is strong, then expectations for a November rate cut will fall, potentially hard, and that could inject some volatility into markets. Bottom line, Goldilocks data is important this week to keep rate cut expectations stable,” says Tom Essaye, founder of Sevens Report Research.

Weather-related factors are expected to distort Friday’s jobs report. “The distortions to this data make the report difficult to rely on, and we doubt that the Fed will be motivated to change tack on policy based on the tone of the data,” advise Jefferies’ economics team in a note to clients on Oct. 25. “Similarly, the drag in October will likely be reversed in November, so we doubt we will have a clean look at the payroll data for the next few months.”

Texas manufacturing activity rebounds in October, according to the Dallas Fed’s monthly survey. “The production index, a key measure of state manufacturing conditions, shot up 18 points to 14.6, its highest reading in more than two years,” the bank reports.

Oil prices fell sharply on Monday, trading below $70 a barrel for the US benchmark (West Texas Intermediate). The decline left oil near a two-year low. Analysts say a factor behind the selling is the limited aspect of Israel’s retaliatory strike on Iran over the weekend — a strike that hit military targets rather than energy infrastructure.

Author: James Picerno