Macro Briefing: 3 April 2024

* Taiwan hit by strongest earthquake in 25 years * Fed officials still expect rate cuts, but not anytime soon * Global manufacturing growth strengthens in March via PMI survey * China manufacturing growth posts strongest pace in 13 months: PMI survey * Eurozone inflation unexpectedly cools to 2…4%…

* Taiwan hit by strongest earthquake in 25 years

* Fed officials still expect rate cuts, but not anytime soon

* Global manufacturing growth strengthens in March via PMI survey

* China manufacturing growth posts strongest pace in 13 months: PMI survey

* Eurozone inflation unexpectedly cools to 2.4% in March

* Tesla’s sales fall, a sign that’s its share of EV market is slipping

* US factory orders rebound sharply in February after two monthly declines

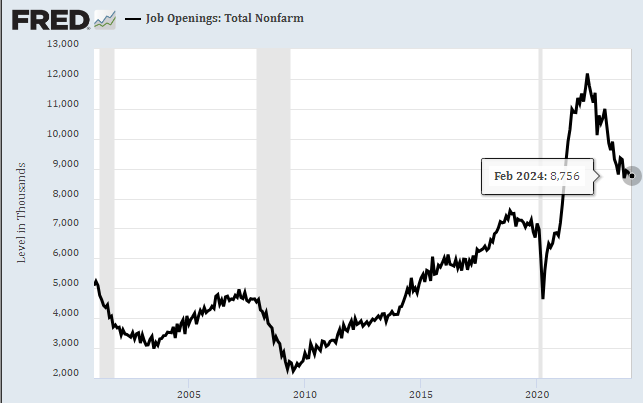

* US job openings edge higher, staying in relatively elevated terrain:

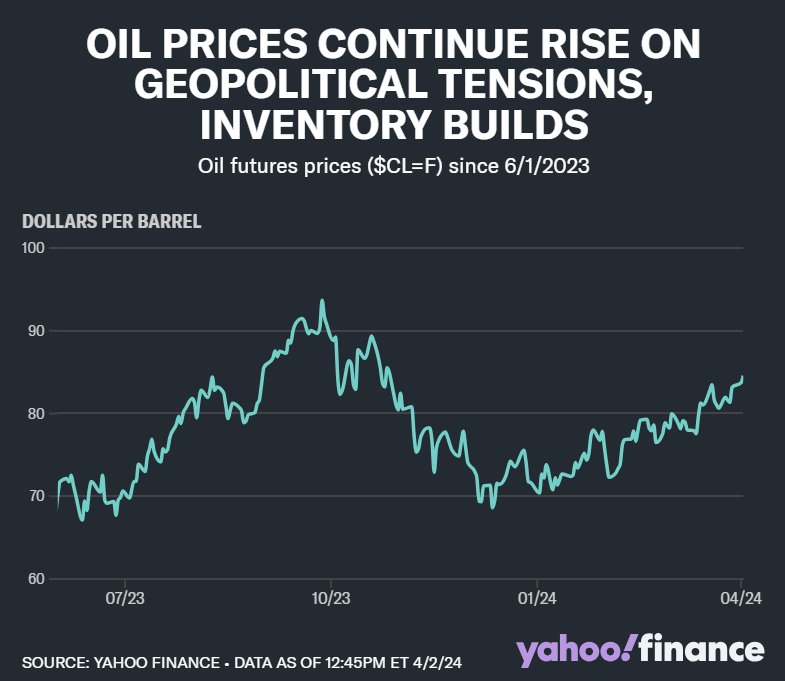

Oil prices rise to highest level since October amid “rising tensions in the Middle East, drone attacks against Russian refineries, and expectations that OPEC+ will maintain its production cuts at least until June,” reports Yahoo Finance. “At face value, and assuming no policy, supply or demand response, Russia’s actions could push Brent oil price to $90 already in April, reach mid-$90 by May and close to $100 by September,” says JPMorgan analyst Natasha Kaneva re: rent crude oil, the international benchmark.

Author: James Picerno