Macro Briefing: 30 July 2024

“If you look big picture any time you think about home builders or housing, you really got to think about what’s gonna be happening with interest rates and with mortgage rates and certainly with the fed, perhaps ready to cut interest rates in September,” says Tyler Battery, Oppenheimer’s ex…

* Longest, deepest US Treasury yield curve inversion may be close to ending

* Eurozone maintains sluggish growth in second quarter

* Sen. Lummis announces bill for US Treasury to establish bitcoin reserve

* AI is improving the accuracy and timeliness of weather forecasting

* Texas manufacturing activity stays flat in July as demand weakens

* Despite expectations of rate cuts, long-term bonds still look risky:

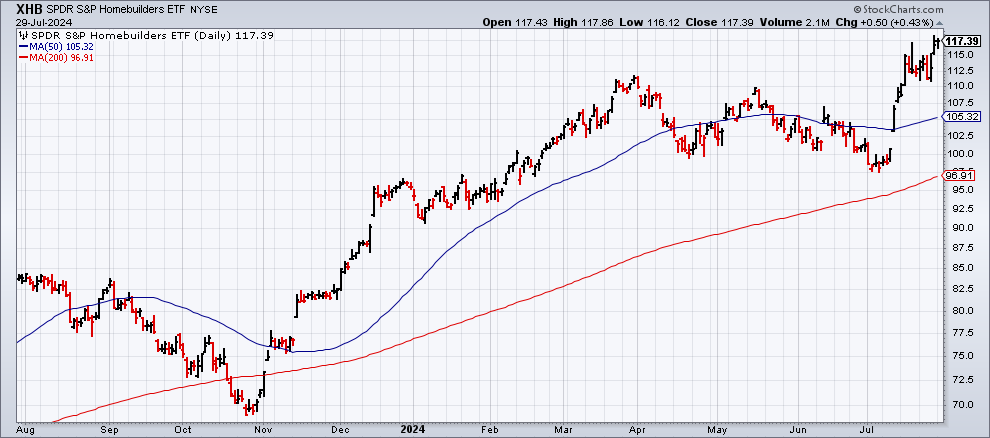

Homebuilder stocks (XHB) surge on expectations that rate cuts are near. “If you look big picture any time you think about home builders or housing, you really got to think about what’s gonna be happening with interest rates and with mortgage rates and certainly with the fed, perhaps ready to cut interest rates in September,” says Tyler Battery, Oppenheimer’s executive director. “I think that’s a positive tailwind for the space.”

Author: James Picerno