Macro Briefing: 30 October 2024

US job openings fell in September to the lowest level since January 2021… “The low level of quits is consistent with a decline in the availability of employment opportunities,” writes Oxford Economics lead US economist Nancy Vanden Houten…”US Consumer Confidence Index rises sharply in O…

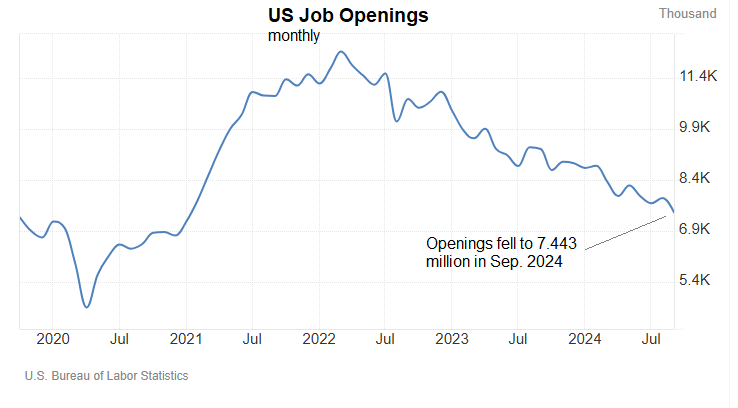

US job openings fell in September to the lowest level since January 2021. “The low level of quits is consistent with a decline in the availability of employment opportunities,” writes Oxford Economics lead US economist Nancy Vanden Houten. “The steady decline in the quits rate is consistent with wage growth continuing to slow and easing the inflationary impulse from the labor market.”

US Consumer Confidence Index rises sharply in October, posting the biggest monthly gain since March. “Consumers’ assessments of current business conditions turned positive,” says Dana Peterson, the Conference Board’s chief economist. “Views on the current availability of jobs rebounded after several months of weakness, potentially reflecting better labor market data.”

The euro zone economy grew 0.4% in the third quarter, beating expectations. Economists predicted a rise of 0.2%, according to a Reuters poll, vs. the bloc’s 0.3% increase in Q2.

Billionaire investor John Paulson, if he becomes Treasury secretary in a second Trump administration, says he would work with Tesla CEO Elon Musk to enact massive federal spending cuts. “All of these tax subsidies for solar, for wind, inefficient, uneconomic energy sources,” says Paulson. “Eliminate that. That brings down spending.”

Nasdaq Index rises to record high as Alphabet reports in after-hours trading third-quarter earnings that beat expectations. The Google parent is the first of five “Magnificent Seven” megacaps due to report this week.

The annual return for US home prices eased to +4.2% in August, according to the S&P CoreLogic Case-Shiller Index. The gain marks a downshift from July’s +4.8%. “This month’s release captures the time period during which [mortgage] rates dropped from roughly 7% to 6.35%,” notes Realtor.com analyst Hannah Jones. “Though significant, this drop in rates has not yet resulted in a significant uptick in demand and home sales activity, which meant home price growth continued to mellow.”

Author: James Picerno