Macro Briefing: 4 August 2025

The 73,000 increase in nonfarm payrolls last month was well below expectations, and raises concern that the labor market will continue to slow… “There’s no way to pretty-up this report…”President Trump fired the commissioner of labor statistics following a weaker-than-expected jobs re…

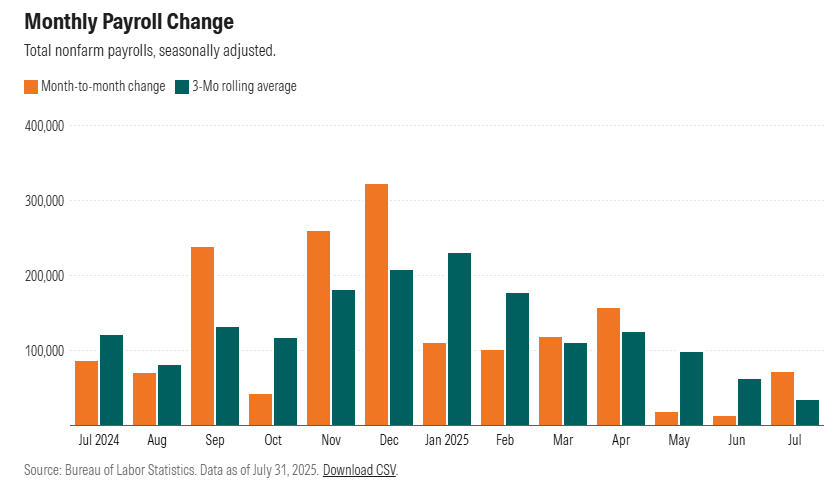

US hiring rebounded in July, but only modestly, following two months of near-stagnant increases. The 73,000 increase in nonfarm payrolls last month was well below expectations, and raises concern that the labor market will continue to slow. “There’s no way to pretty-up this report. Previous months were revised significantly lower where the labor market has been on stall-speed,” said Brian Jacobsen, Chief Economist at Annex Wealth Management. “Last year the Fed messed up by not cutting in July so they did a catch-up cut at their next meeting. They’ll likely have to do the same thing this year.”

President Trump fired the commissioner of labor statistics following a weaker-than-expected jobs report for July. “I was just informed that our Country’s ‘Jobs Numbers’ are being produced by a Biden Appointee, Dr. Erika McEntarfer, the Commissioner of Labor Statistics, who faked the Jobs Numbers before the Election to try and boost Kamala’s [Harris’] chances of Victory,” he wrote on social medaia. “We need accurate Jobs Numbers. I have directed my Team to fire this Biden Political Appointee, IMMEDIATELY. She will be replaced with someone much more competent and qualified.”

Fed governor Adriana Kugler is resigning, offering President Trump an opportunity for a new appointment to the central bank. The President said he has a “couple of people in mind” and will announce a replacement for Kugler “probably over the next couple days.”

BP reports its biggeset oil discovery in decades. The oil and gas discovery is off the coast of Brazil and could be the largest find since 1999 for the firm.

82% of S&P 500 companies have reported a positive earnings-per-share surprise and 79% of companies have reported a positive revenue surprise to date for Q2 data, according to FactSet. “For Q2 2025, the blended (year-over-year) earnings growth rate for the S&P 500 is 10.3%. If 10.3% is the actual growth rate for the quarter, it will mark the third consecutive quarter of double-digit earnings growth for the index,” the consultancy reports.

The US 10-year Treasury yield fell sharply on Friday, dropping to 4.22% — the lowest close since Apr. 30:

Author: James Picerno