Macro Briefing: 4 June 2025

US job openings rose in April, highlighting resilience in the labor market…” Recent rally in US stock market narrows fair-value discount to -3%, according to Morningstar: “As of May 30, 2025, according to a composite of our valuations, the US stock market was trading at a 3% discount to fair v…

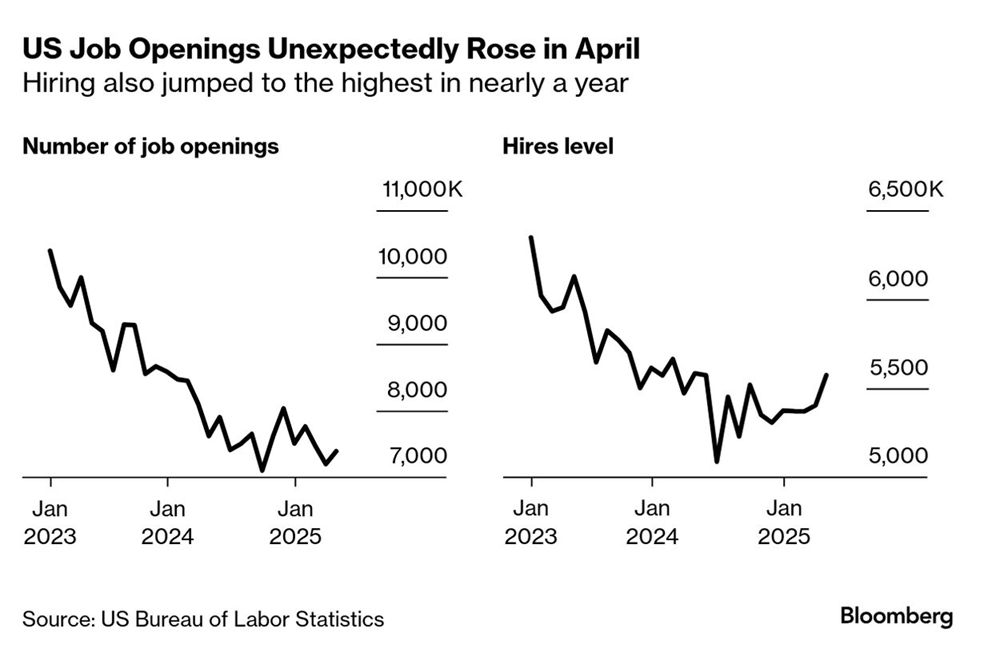

US job openings rose in April, highlighting resilience in the labor market. Despite uncertainty related to the trade war, the Labor Department reported that employers posted 7.4 million job vacancies in April, up from 7.2 million in March. “Once companies are more certain that bad times are coming, they will start to shed workers,” Carl Weinberg, chief economist at High Frequency Economics, wrote in a commentary. “However, the economy is still near full employment. We suspect companies are still hoarding workers until they are very, very sure about an economic downturn.″

US factory orders fell sharply in April, reversing a sharp gain in the previous month, which was driven by front-loading effects ahead of tariffs. Factory orders fell 3.7% after an unrevised 3.4% jump in March, the Commerce Department’s Census Bureau said on Tuesday.

US factories are reporting increasingly longer delivery times for supplies as tariff disruptions roil supply chains. “The administration’s tariffs alone have created supply chain disruptions rivaling that of COVID-19,” an electric equipment manufacturer told the Institute for Supply Management in the group’s survey published this week.

Eurozone inflation fell to 1.9% in May, below the central bank’s target. The softer inflation data implies that another round of interest rate cuts for the curerency bloc is warranted.

US workers are saving a record amount of their income for retirement. The Wall Street Journal reports: “The average savings rate in 401(k) plans rose to a record high 14.3% of income in the first three months of this year, according to a Fidelity Investments analysis of the millions of accounts it manages. That is just a shade below the 15% annual savings rate financial advisers often recommend over a four-decade career.”

Recent rally in US stock market narrows fair-value discount to -3%, according to Morningstar: “As of May 30, 2025, according to a composite of our valuations, the US stock market was trading at a 3% discount to fair value. Historically, that was close to the midpoint, where half the time the market trades at a higher valuation and half the time at a lower valuation. While we remain market weight at this valuation, we’d prefer to see more of a margin of safety in light of the higher-than-average downside risk potential.”

Author: James Picerno