Macro Briefing: 4 March 2024

* New concerns for regional banks after NY Community Bancorp rating cut to junk * Rising tide of new laws reshape how Big Tech operates around the world * Japan’s stock market rally persists: Nikkei 225 index tops 40,000 for first time * Several OPEC+ countries extend voluntary oil-supply cuts * U…

* New concerns for regional banks after NY Community Bancorp rating cut to junk

* Rising tide of new laws reshape how Big Tech operates around the world

* Japan’s stock market rally persists: Nikkei 225 index tops 40,000 for first time

* Several OPEC+ countries extend voluntary oil-supply cuts

* US economic strength inspires some to argue no rates cuts are likely in 2024

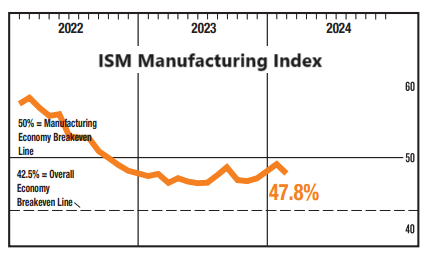

* ISM manufacturing index in February shows sector contraction continues:

It’s still premature to declare victory in war on inflation, analysts advise. A series of hot January prints is “a warning sign that this is not going to be as simple as we thought,” says Roger Aliaga-Díaz, global head of portfolio construction and chief economist, Americas at Vanguard. The higher-than-expected increase in PCE inflation in January persuades some analysts that taming pricing pressure is still a work in progress. “This seems like a bump in the road,” says Blerina Uruçi, chief US economist at T. Rowe Price. “Some factors driving prices higher may not be sustained in the coming months,” she says, but January’s data “does signal that the very steady deceleration in inflation that we saw in the second half of the year seems to have lost some steam.”

Author: James Picerno