Macro Briefing: 4 November 2024

The 12,000 increase in new jobs last month reflects a near-flat performance after September’s strong 223,000 increase… labor market, but under the surface is a muddy report roiled by climate and labor disruptions,” says Cory Stahle, an economist at the Indeed Hiring Lab… “While the impact…

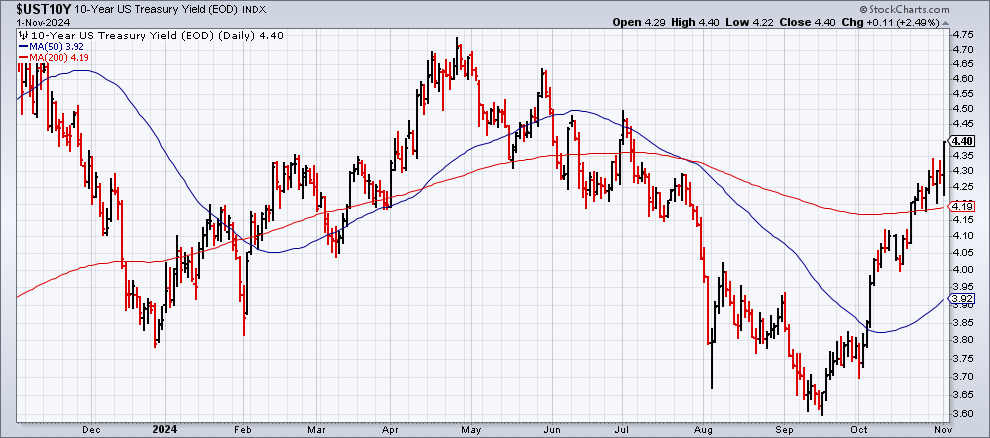

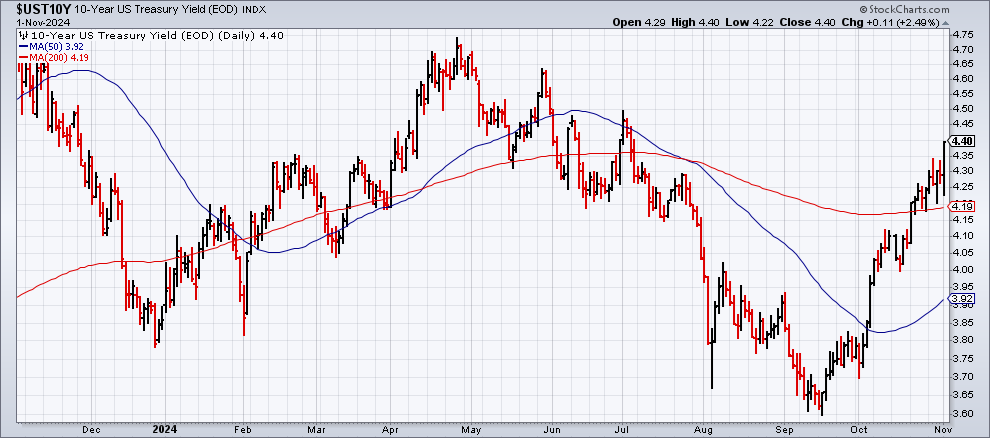

The US 10-year Treasury yield rose to 4.40% on Friday, a four-month high. The head of rates strategy at TD Securities, Gennadiy Goldberg, says the 10-year could approch 5% if Trump wins the election and the Republicans sweep in Congress. Reuters reports: “If Republicans take both houses of Congress and the U.S. presidency, it likely would bring higher tariffs, and consequently higher interest rates, especially at the back end of the yield curve, due to inflation. Increased U.S. Treasury debt supply to finance a huge fiscal deficit also lifts longer-end yields.” If Democrats win: “it could bring higher taxes on corporations and higher-income households that could weigh on economic growth. Disinflation is likely and as such, more aggressive easing by the Federal Reserve would be possible. Interest rates are likely to decline in this environment, led by the front end of the curve.”

Hiring in the US slowed sharply in October, reportedly due to the temporary effects of hurricanes and labor strikes. The 12,000 increase in new jobs last month reflects a near-flat performance after September’s strong 223,000 increase. “At first glance, October’s jobs report paints a picture of growing fragility in the U.S. labor market, but under the surface is a muddy report roiled by climate and labor disruptions,” says Cory Stahle, an economist at the Indeed Hiring Lab. “While the impacts of these events are real and should not be ignored, they are likely temporary and not a signal of a collapsing job market.”

The euro area manufacturing downturn continued into the fourth quarter, according to October PMI survey data. “There is one bit of good news in these numbers: the recession in the manufacturing sector did not deepen further in October,” says Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank.

US clean energy industry outlook dependent on who wins the election, according to several forecasts. “A Harris-Walz win next Tuesday is good news for the offshore wind industry. A Trump-Vance win next Tuesday is terrible,” says Sean McGarvey, president of the North America’s Building Trades Unions, which works on offshore wind projects. A recent survey of 900 companies in the clean energy industry reports that 53% expect to lose business if the Inflation Reduction Act, passed during the Biden administration, was repealed, and 21% expected they would have to lay off workers.

OPEC says it would extend oil-production cuts through the end of 2024. The cartel’s announcement follows a similar extension in June, when OPEC said a voluntary cut of 2.2 million barrels of oil a day was extended until September.

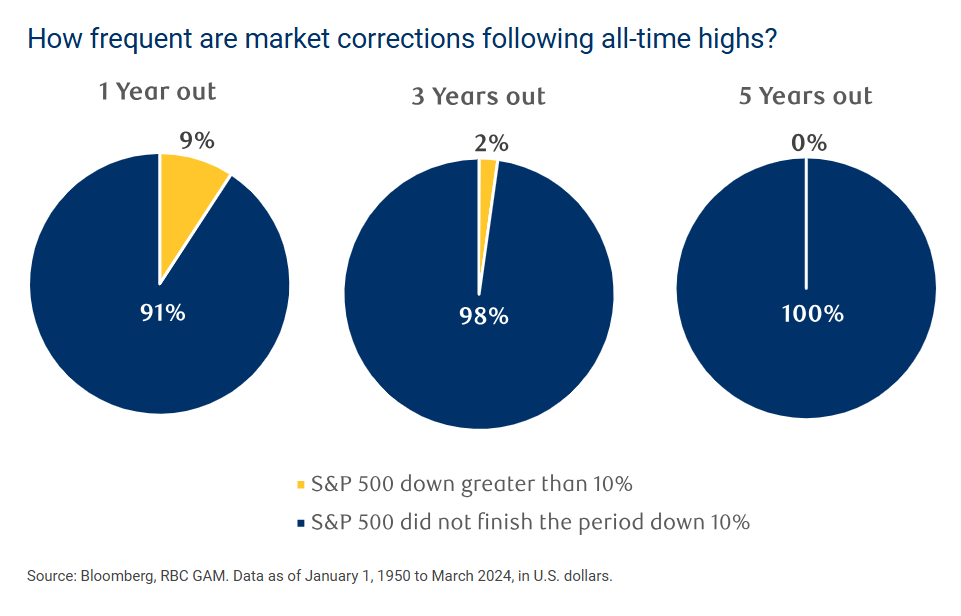

How frequently are market corrections, after a record high, followed by new peaks? RBC Global Asset Management studied the S&P 500 Index’s history and finds, perhaps not surprisingly, that corrections tend to lead to new all-time highs in short order? Why? The basic reason: the US stock market tends to rise over time. The chart belows summarizes results of the S&P 500 Index’s decline of greater than 10% and the subsequent changes for the subsequent 1-, 3- and 5-year periods since 1950. For example, one year after each all-time high in the S&P 500 market corrections greater than 10% have occurred only 9% of the time:

Author: James Picerno