Macro Briefing: 5 June 2024

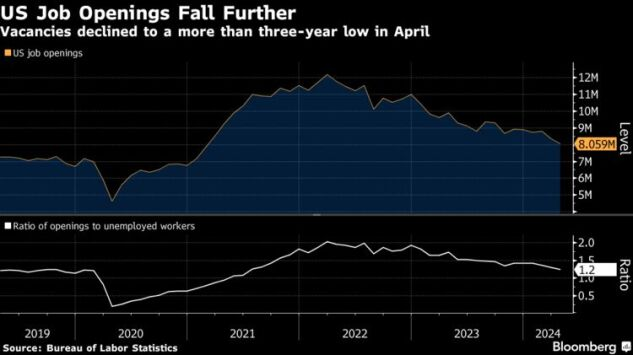

* US 10-year Treasury yield drops sharply for fourth straight day * Eurozone economy grows at fastest rate in a year: PMI survey data * China services sector grows at fastest pace in 10 months * US factory orders rose for a third straight month in April * US job openings fell in April to lowest leve…

* US 10-year Treasury yield drops sharply for fourth straight day

* Eurozone economy grows at fastest rate in a year: PMI survey data

* China services sector grows at fastest pace in 10 months

* US factory orders rose for a third straight month in April

* US job openings fell in April to lowest level in over 3 years:

US stock-bond correlation is running at the highest level in several decades, based on rolling 1-year correlation for a pair proxy ETFs (SPY for stocks and IEF for US Treasuries). The moderately positive correlation is associated with relatively weak diversification benefits for a stock-bond portfolio. The US Treasury yield curve, when it begins to normalize, may offer an early sign that the increase in the stock-bond correlation is set to normalize, advises a research note from TMC Research.

Author: James Picerno