Macro Briefing: 5 March 2024

“The good news is the labor market and economy are prospering, furnishing the (Federal Open Market) Committee the luxury of making policy without the pressure of urgency……

* Rebound in economic sentiment isn’t translating into stronger support for Biden

* China services sector continues to expand at moderate rate in February

* China stocks rally to 3-month highs as Beijing targets 5% GDP growth

* Inflows into Bitcoin ETFs surge, helping drive price near a record high

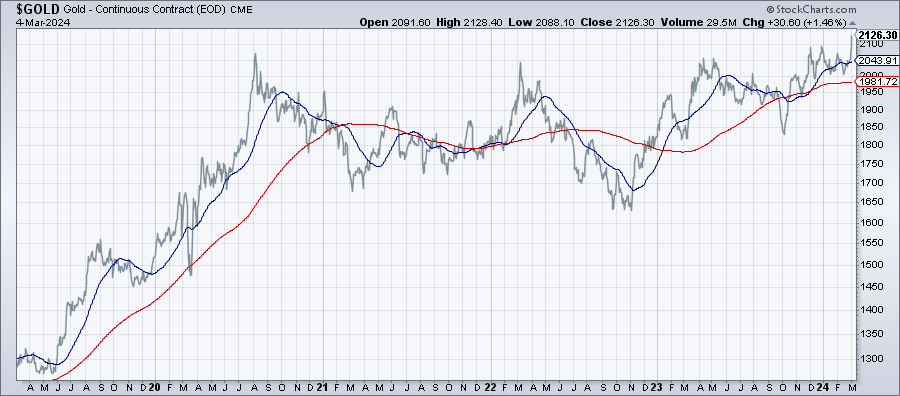

* Gold rises to record high above $2,100/oz on Monday:

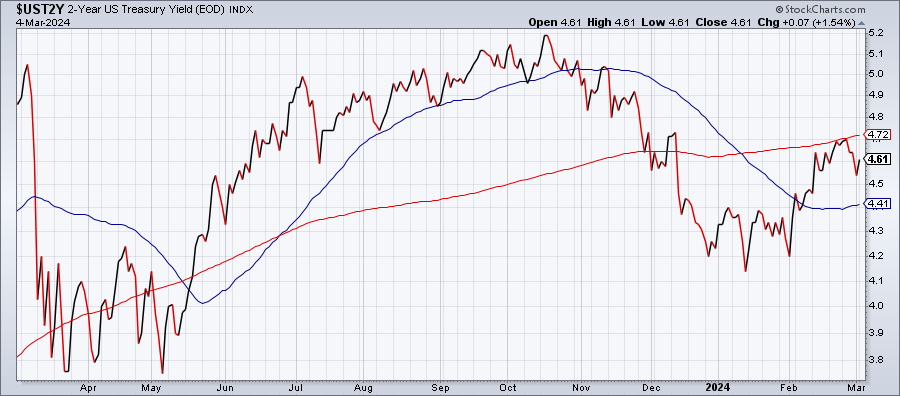

Fed heads deliver (slightly) mixed messages. New York Fed President John Williams says rate cuts are probably coming later this year, but Atlanta Fed President Raphael Bostic offers a more cautious outlook. “Only when I gain that confidence will I feel the time is right to begin lowering the federal funds rate,” says Bostic. “The good news is the labor market and economy are prospering, furnishing the (Federal Open Market) Committee the luxury of making policy without the pressure of urgency.” Meanwhile, the policy-sensitive US 2-year Treasury yield closed near a three-month high on Monday:

Author: James Picerno