Macro Briefing: 5 May 2025

Job numbers remain very strong, suggesting there was an impressive degree of resilience in the economy in play before the tariff shock,” said Seema Shah, chief global strategist at Principal Asset Management…2% and nonfarm payrolls rose increased a seasonally adjusted 177,000 last month… “W…

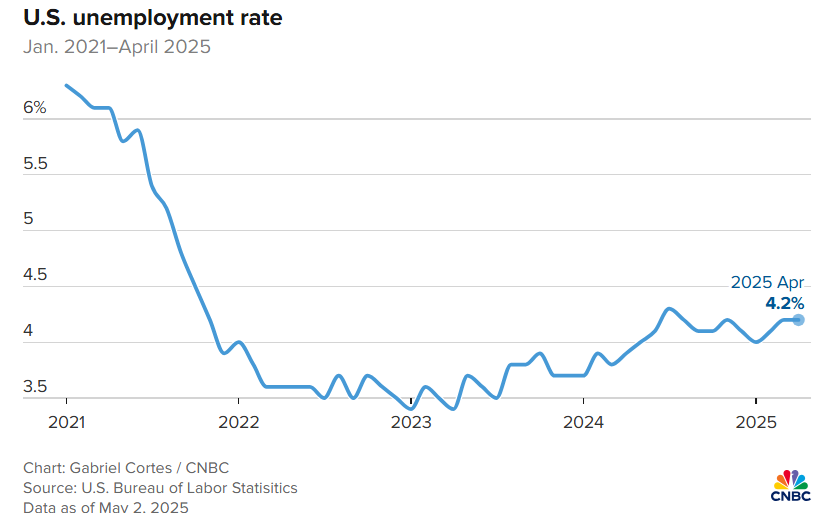

The US unemployment rate was steady in April at 4.2% and nonfarm payrolls rose increased a seasonally adjusted 177,000 last month. “We can push recession concerns to another month. Job numbers remain very strong, suggesting there was an impressive degree of resilience in the economy in play before the tariff shock,” said Seema Shah, chief global strategist at Principal Asset Management. “The economy will weaken in the coming months but, with this underlying momentum, the U.S. has a decent chance of averting recession if it can step back from the tariff brink in time.”

Trump said he would not fire Federal Reserve chair Jerome Powell but the President continued to push for rate cuts. “He should lower them. And I wish the people that are on that [Fed] board would get him to lower because we are at a perfect time. It’s already late,” Trump said in an interview on Sunday.

Oil prices drop after OPEC says it will boost production. The group, led by Saudi Arabia, said on Saturday it would increase output by 411,000 barrels per day in June. A month ago, OPEC+ surprised the market by announced a similar increase in production for May.

Trump adds foreign movies to a list for US tariffs. He said he was authorizing the Department of Commerce and Trade Representative to start the process to impose a 100% on foreign-made movies to counter a “National Security threat”.

The Federal Reserve is expected to leave its target rate unchanged at Wednesday’s policy announcement. Fed funds futures are pricing in a roughly 97% probability that the central bank will leave the 4.25%-to-4.50% target range unchanged.

Author: James Picerno