Macro Briefing: 7 August 2024

* Consumer spending will be a key factor for gauging US recession risk * Markets expect Fed to head off a recession with rate cuts * US trade deficit narrowed in June as exports outpace imports * Americans continue to rack up credit card debt, which rose to a new high in Q2 * Sahm Rule-creator doesn…

* Consumer spending will be a key factor for gauging US recession risk

* Markets expect Fed to head off a recession with rate cuts

* US trade deficit narrowed in June as exports outpace imports

* Americans continue to rack up credit card debt, which rose to a new high in Q2

* Sahm Rule-creator doesn’t recommend emergency Fed rate cut

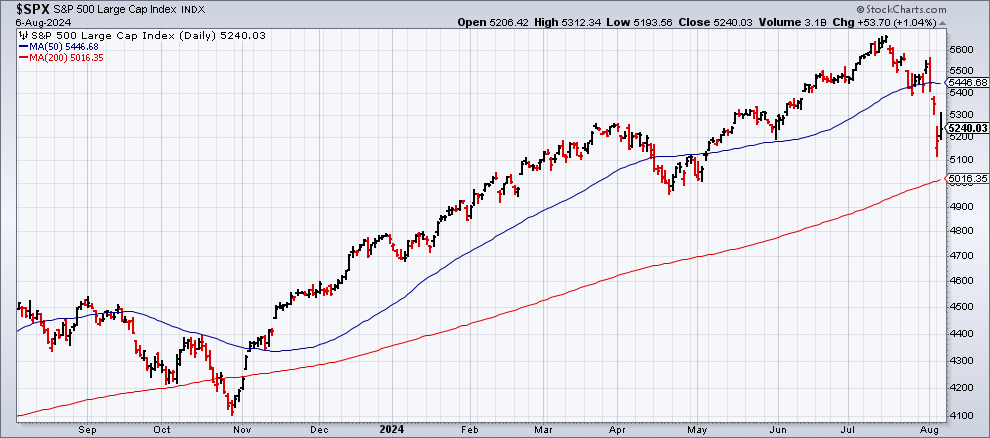

* US stock market (S&P 500) claws back some of the loss after 3-day sell-off:

In the wake of the recent sell-off, the current drawdown for the US stock market is still at relatively moderate level, reports a new research note from TMC Research, a division of The Milwaukee Co. “The recent sell-off in the US stock market was, as usual, greeted by many in the press with headlines of doom and gloom. But measured against the historical record, the current peak-to-trough decline for the S&P 500 Index still ranks as a relatively common event.”

Author: James Picerno