Macro Briefing: 7 March 2024

“As central banks begin to shrink their balance sheets through quantitative tightening, the net supply of bonds to be absorbed by the broader market will increase to record levels,” the OECD advises… “This will result in a growing share of bonds being held by more price sensitive investors,…

* House approves first step to avert partial government shutdown

* Fed’s Powell says he expects rate cuts this year in House testimony, but…

* Powell also says he needs “see a little bit more data” before moving on rates

* China’s exports and imports beat estimates, suggest improving demand

* China could flood US electric-vehicle market with its cars, says Energy Secretary

* US companies hired more workers in February vs. January, ADP estimates

* US economy accelerated slightly in early 2024: Fed Beige Book

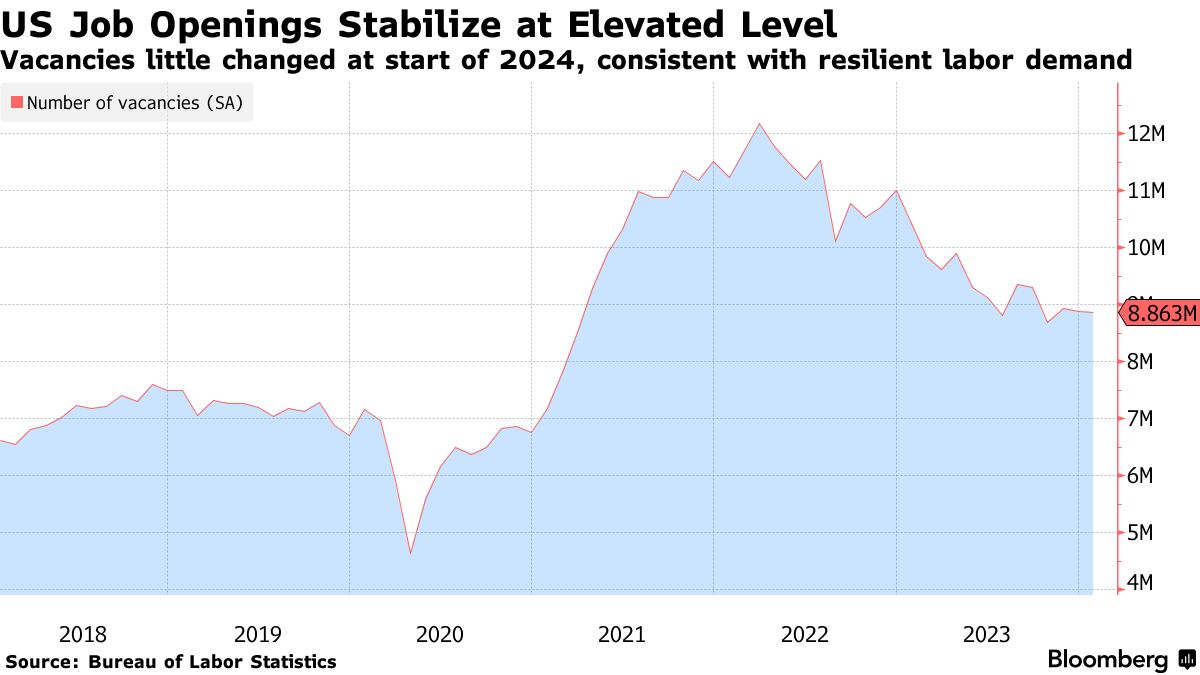

* US job openings are steady at elevated level in January:

Total borrowing by governments in rich countries is expected to reach a record high in 2024, the OECD estimates. “As central banks begin to shrink their balance sheets through quantitative tightening, the net supply of bonds to be absorbed by the broader market will increase to record levels,” the OECD advises. “This will result in a growing share of bonds being held by more price sensitive investors, such as the non-bank financial sector and households.”

Author: James Picerno