Macro Briefing: 8 May 2025

The 2-year yield continues to trade at 55 basis points below the median 4…Trump announced he will sign trade deal with Britain, the first since he announced sweeping global tariffs… Bessent as the point person for trade talks with China this weekend… Meanwhile, the President continues to r…

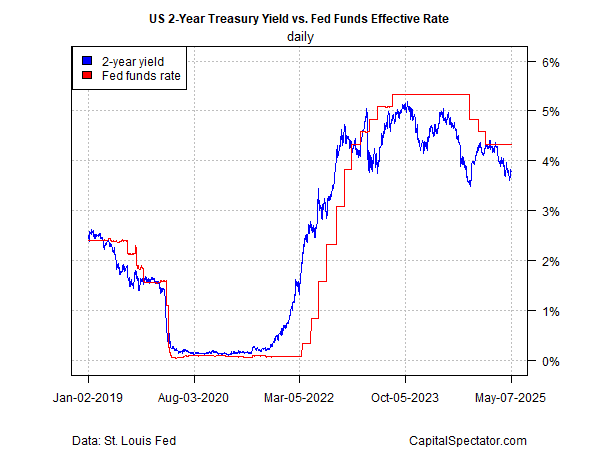

The policy-sensitive US 2-year yield holds steady at 3.78% as Federal Reserve leaves its target rate unchanged. The 2-year yield continues to trade at 55 basis points below the median 4.33% Fed funds rate, a sign that the market continues to price in expectations for a rate cut. Fed Chairman Powell, citing elevated uncertainty about inflation and economic activity related to tariffs, said the central bank does not “need to be in a hurry” to change policy as it waits for a clearer picture of how macro conditions are evolving.

Trump announced he will sign trade deal with Britain, the first since he announced sweeping global tariffs. Writing on social media, the President said: “This should be a very big and exciting day for the United States of America and the United Kingdom. Press Conference at The Oval Office, 10A.M.”

Trump assigns Treasury Sec. Bessent as the point person for trade talks with China this weekend. The meeting in Geneva comes as US ports are reporting a dip in shipments to lows not seen since the Covid-19 pandemic, a decline which will soon ripple through the wider economy. Meanwhile, the President continues to reject calls to lower US tariffs on China in order to promote trade-war negotiations with Beijing.

Despite a rise in recession forecasts for the US, evidence for a downturn is scarce in official data, at least so far. “The problem is we don’t have much to hang onto at this point,” said Marc Giannoni, chief U.S. economist for Barclays. “We have to rely on anecdotes, on indicators that are nonconventional.”

The ex ante 10-year return for the US stock market is expected to be considerably lower vs. recent history, according to analysis by TMC Research, a unit of The Milwaukee Company, a wealth manager. The S&P 500 is projected to earn 5.5% annualized over the next ten years, based on the average estimate for five models. That’s well below the 10%-plus performance that’s prevailed lately.

Author: James Picerno