Macro Briefing: 8 November 2024

US jobless claims tick up after dropping to five-month low…The policy-sensitive US 2-year Treasury yield fell on Wednesday as the Federal Reserve announced a widely-expected 1/4-point cut in its target rate… Despite the slide in the 2-year yield, it’s unclear if the upside trend will pause or…

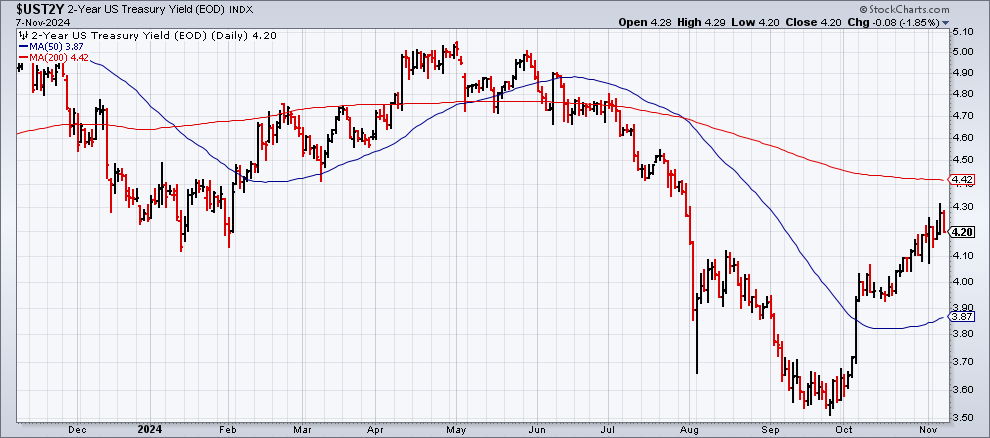

The policy-sensitive US 2-year Treasury yield fell on Wednesday as the Federal Reserve announced a widely-expected 1/4-point cut in its target rate. Despite the slide in the 2-year yield, it’s unclear if the upside trend will pause or reverse. The 2-year yield is widely followed as a proxy for near-term policy expectations. As of yesterday’s close, the 2-year yield, at 4.20%, remains modestly below the 4.50%-4.75%, which implies a forecast for another rate cut. Fed funds target range. Fed funds futures are pricing in a 71% probability for a 1/4 rate cut at next month’s FOMC meeting.

Average yield on US 30-year mortgage rate rose for a sixth straight week. The rate ticked up to 6.79% from 6.72% last week, mortgage buyer Freddie Mac said Thursday. That’s still down from a year ago, when the rate averaged 7.5%.

China unveils $1.4 trillion debt package to boost the economy. The announcement follows a series of efforts to stimulate growth.

Shares of renewable energy companies fell sharply on Wednesday, driven lower on concerns that the incoming Trump administration will enact policies that reduce the competitiveness of firms in this industry. “Markets always move in an over-reactionary way, and I do believe the reactions we are seeing are pretty immediate and pretty exaggerated,” says Kevin Kang, a senior associate at Enverus Intelligence Research, said.

US jobless claims tick up after dropping to five-month low. New filings for unemployment beneifts rose to 221,000, but remain low by historical standards, suggesting that a growth bias endures for the labor market.

Author: James Picerno