Macro Briefing: 8 October 2024

US consumer credit continued rising in August, according to the Federal Reserve… Overall consumer credit increased at an annual rate of 2…org reports: “Revolving debt — that’s mostly on credit cards — was down 1… Even after the Fed’s long-awaited rate cut, high interest rates on tho…

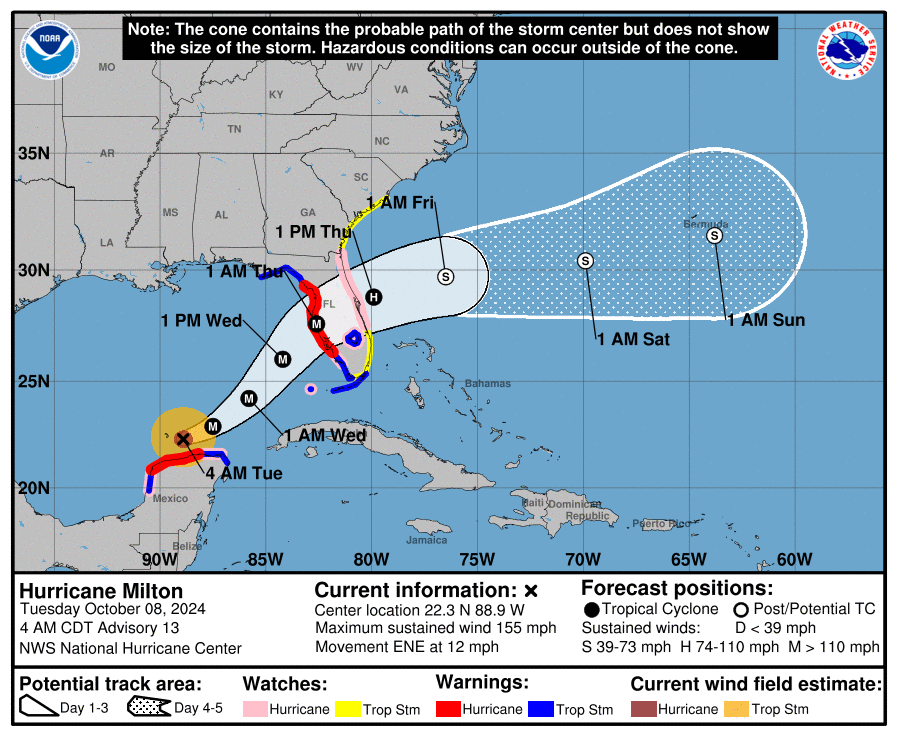

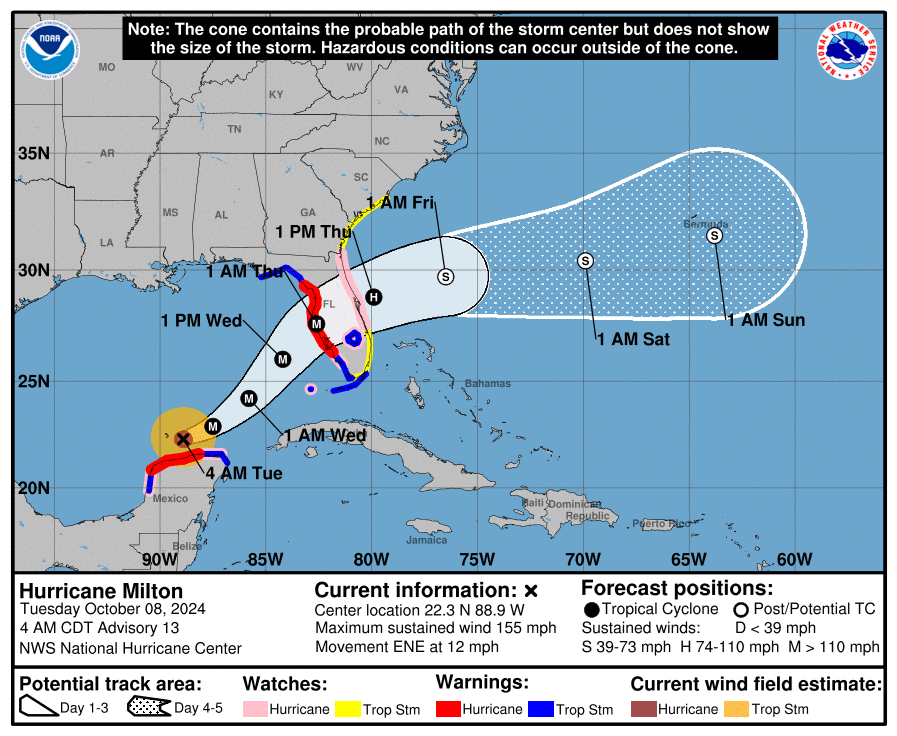

Hurricane Milton threatens “grave danger” for west-central Florida, reports The Weather Channel. Citing the National Hurricane Center: “Milton has the potential to be one of the most destructive hurricanes on record” for the Tampa-St. Pete region.

US small business sentiment ticked higher in September but remains near the lowest level in a decade, based on a survey index published by NFIB. “Small business owners are feeling more uncertain than ever,” says NFIB Chief Economist Bill Dunkelberg.

China outlines more economic stimulus but refrains from major spending plans. The announcement has “largely disappointed with no new stimulus measures announced,” says Shaun Lim, FX strategist at Maybank in Singapore.

US consumer credit continued rising in August, according to the Federal Reserve. Overall consumer credit increased at an annual rate of 2.1%. Marketplace.org reports: “Revolving debt — that’s mostly on credit cards — was down 1.2%. Even after the Fed’s long-awaited rate cut, high interest rates on those credit cards have barely budged. That could be troubling as we head into the holiday shopping season.”

The sharp rise in oil prices in recent days reflects worries that Israel may strike Iran’s energy infrastructure in retaliation for the Tehran’s recent missile strike. “This is an extraordinarily precarious global situation,” says Kenneth Rogoff, a former chief economist at the International Monetary Fund who is now a professor at Harvard University. “The world is probably the most unstable that it’s been since the Cold War. That’s not even mildly an overstatement. It could get worse in a hurry. That would certainly have a big impact on the global economy.” Tamas Varga of oil brokerage PVM adds: “”Oil can keep ascending only for so long purely based on perceptions and not actual supply disruption … although it would be irresponsible to claim that the dust has settled on Iran’s direct and ominous involvement in the conflict, but for now the threats of Israeli assaults on Iranian oil infrastructure have not materialized yet.” The US crude oil benchmark — WTI — closed at $77 a barrel, the highest in more than a month.

Author: James Picerno