Macro Briefing: 9 April 2024

* Yellen won’t rule out new US tariffs on China’s green energy exports * Uncertainty among economists continues to rise about prospects for rate cuts * Short-Term consumer inflation expectations are stable at 3%: NY Fed survey * Higher-for-longer interest rates could support US dollar * Gold fut…

* Yellen won’t rule out new US tariffs on China’s green energy exports

* Uncertainty among economists continues to rise about prospects for rate cuts

* Short-Term consumer inflation expectations are stable at 3%: NY Fed survey

* Higher-for-longer interest rates could support US dollar

* Gold futures rise to yet another record high on Tuesday

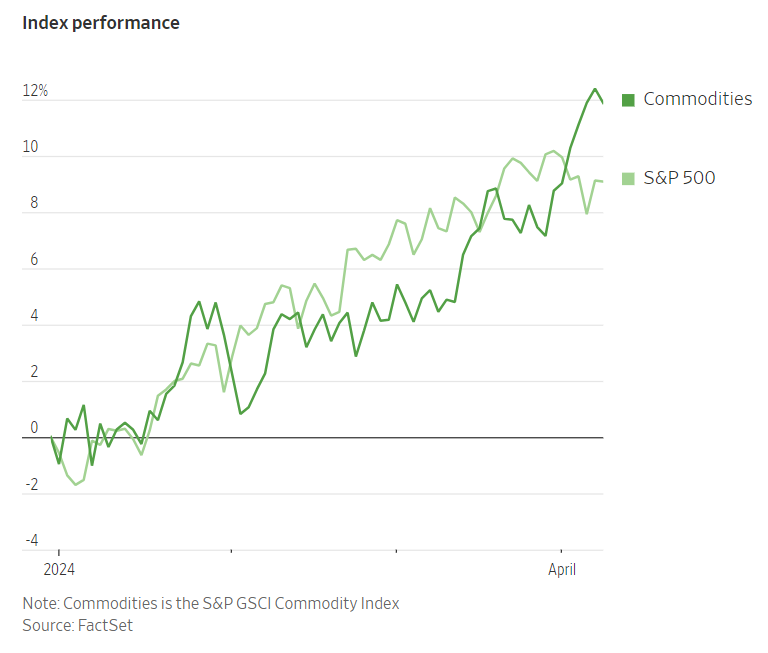

* Rally in commodities reflects strong economy but also poses inflation risk:

Three rate cuts for 2024 is the “base case,” says former St. Louis Fed Chairman James Bullard. “At this point, you should probably take the committee and chair at face value — their best guess right now is still three cuts this year,” he said on Bloomberg TV. “That’s the base case.” Meanwhile, the policy-sensitive US 2-year Treasury yield rose to 4.78% on Tuesday (Apr. 8), the highest since November–another sign that the market continues to downgrade the prospects for rate cuts in the near term.

Author: James Picerno