Major Asset Classes | June 2025 | Performance Review

Stocks in emerging markets extended their rally in June, posting the strongest gain for the major asset classes last month, based on a set of ETFs… A broad measure of US equities delivered a robust second-place performance amid rallies for all the main categories of global markets for the month……

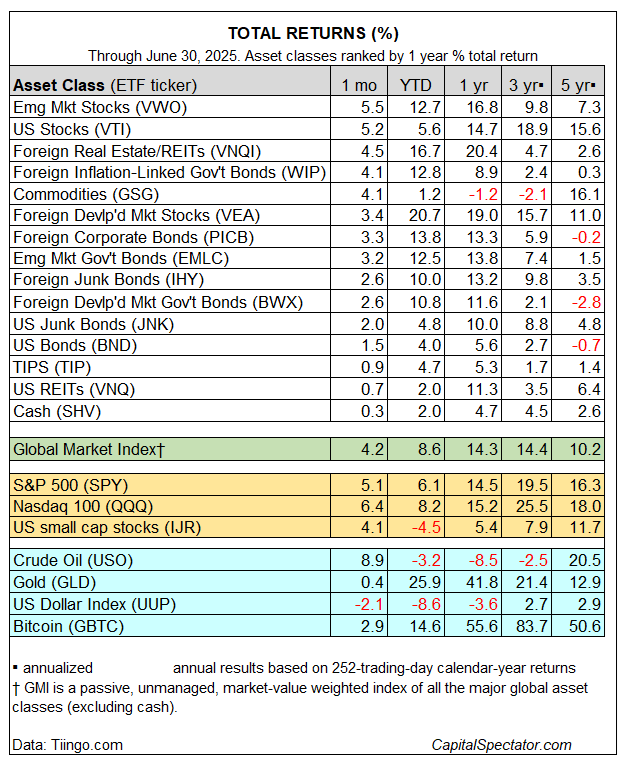

Stocks in emerging markets extended their rally in June, posting the strongest gain for the major asset classes last month, based on a set of ETFs. A broad measure of US equities delivered a robust second-place performance amid rallies for all the main categories of global markets for the month.

The Vanguard Emerging Markets Stock Index ETF (VWO) rose 5.5%, June’s leader. The fund has posted a gain in every month so far this year except for a slight loss in April. For 2025 so far, VWO is up 12.7%.

US stocks (VTI) also rallied last month, rising 5.2%. The increase marks a second straight monthly advance following a three-month run of declines for American shares.

Year to date, foreign stocks in developed markets continue to enjoy a commanding lead for the major asset classes. Vanguard FTSE Developed Markets ETF (VEA) is up 20.7% year to date, well ahead of the second-best performer in 2025: foreign real estate shares (VNQI) with a 16.7% increase in 2025 through June 30.

The Global Market Index (GMI) also posted a solid gain in June via a 4.2% rise. Year to date GMI is up 8.6%, reflecting a strong rally for this multi-asset-class benchmark.

GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for globally diversified multi-asset-class portfolio strategies.

Author: James Picerno