Major Asset Classes | October 2025 | Performance Review

US stocks topped returns for the major asset classes in October, regaining the leadership position for the first time in five months, based on a set of ETFs…2% last month, marking the sixth straight monthly gain…Last month losers were concentrated in real estate, US junk and foreign bonds……

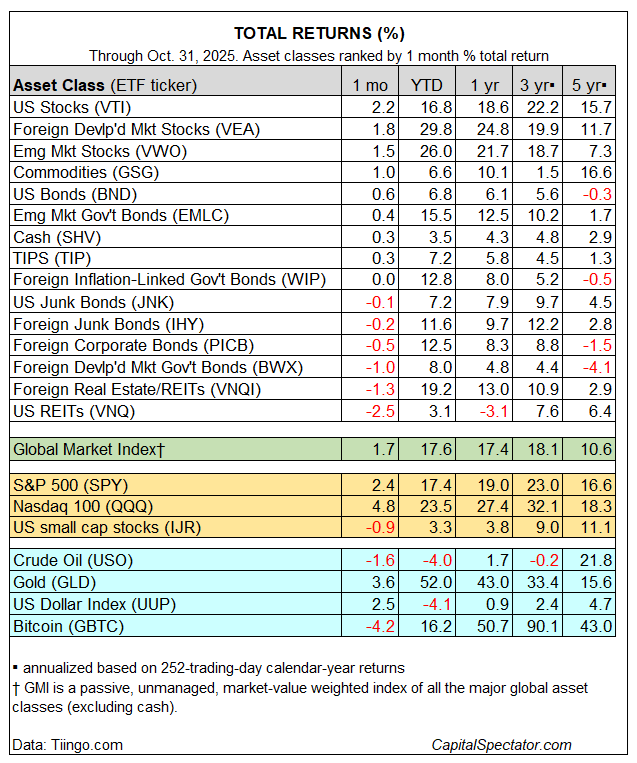

US stocks topped returns for the major asset classes in October, regaining the leadership position for the first time in five months, based on a set of ETFs.

The Vanguard Total US Stock Market Index Fund ETF (VTI) rose 2.2% last month, marking the sixth straight monthly gain. Foreign stocks in developed (VEA) and emerging markets (VWO) followed up with the second- and third-best rallies, respectively, in October.

Last month losers were concentrated in real estate, US junk and foreign bonds. The deepest setback: US real estate investment trusts (VNQ), which fell 2.5%.

For year-to-date results, foreign stocks in developed (VEA) and emerging (VWO) markets are still leading by a wide margin.

All the major asset classes are posting gains this year – US property (VNQ) is the weakest performer, rising a relatively modest 3.1%.

The Global Market Index (GMI) extended its streak of monthly gains in October, rising 1.7%. The advance marks the seventh straight monthly increase. Year to date, GMI is up a strong 17.6%, well above its long-run performance.

GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for globally diversified multi-asset-class portfolio strategies.

Author: James Picerno