Market Trends Continue To Lean Into A Bullish Signal

At the start of the trading week this ratio touched a new record high before edging down on Tuesday and Wednesday…The US equities market isn’t quite as hot as AOA:AOK, but its close, based on the ratio US stocks (SPY) vs… Relative to the broad market (SPY), this ratio looks set to reach a n…

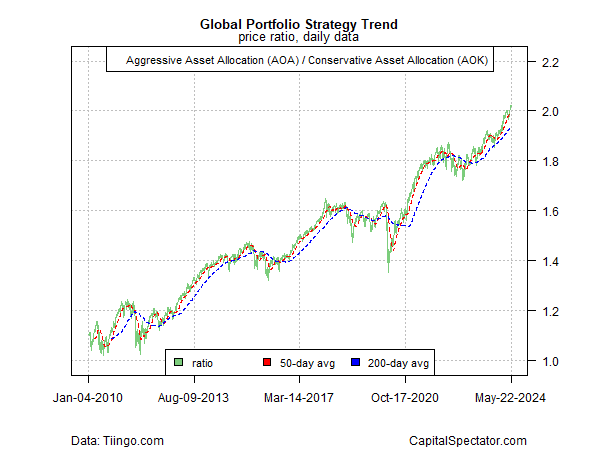

The old saw that markets climb a wall of worry is alive and kicking. Although there are plenty of warnings from analysts who see trouble ahead, trend profiles show no fear, via several pairs of ETF proxies for profiling the appetite for risk, based on prices through yesterday’s close (May 22).

What some see as a gravity-defying run higher extends similar profiles from earlier this year (see here and here). The party must end eventually, as all bull runs do, but for the moment the bias for risk-on remains conspicuous.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

The net-positive bias still looks strong generally via an aggressive global asset allocation portfolio (AOA) vs. its conservative counterpart (AOK). At the start of the trading week this ratio touched a new record high before edging down on Tuesday and Wednesday.

The US equities market isn’t quite as hot as AOA:AOK, but its close, based on the ratio US stocks (SPY) vs. a low-volatility subset (USMV).

A key bellwether for stocks these days is the semiconductor industry (SMH), which is on track to rise for a fifth straight week. Relative to the broad market (SPY), this ratio looks set to reach a new peak soon.

A possible early warning sign that the bulls are becoming tired is the recent drop in housing stocks (XHB) relative US equities overall (SPY). This ratio has fallen in recent days, closing yesterday at the lowest level since February.

Meanwhile, the recent rally in medium-term US Treasuries (IEF) vs. shorter-term counterparts (SHY) is stalling again, suggesting that the long-running bear market in bonds has yet to run its course.

A potentially worrisome sign for the overall risk appetite is the rebound in inflation-indexed Treasuries (TIP) vs. conventional government bonds (IEF). The market appears to be flirting with a new run of reflation, but is still on the fence. This ratio remains well short of its previous peak in October. If and when TIP:IEF sets a new high, it would signal trouble for animal spirits.

Author: James Picerno