Markets Confident That Rate Cuts Will Start In September

Meanwhile, a Fed funds model I developed for TMC Research also points to a lower target rate… Using data through July 8, this model estimated the optimal target rate at roughly 4… Fed funds futures are now pricing in a high probability (90%-plus) that the central bank will start cutting rates …

We’ve been here before. Markets price in high odds that the Federal Reserve will soon start cutting interest rates only to learn otherwise. Is this time different? That’s the bet… again.

To be sure, there are several compelling reasons to assume that rate cuts are near. Another encouraging inflation report helps. Signs that the US economy is slowing is another factor that supports a dovish pivot for monetary policy.

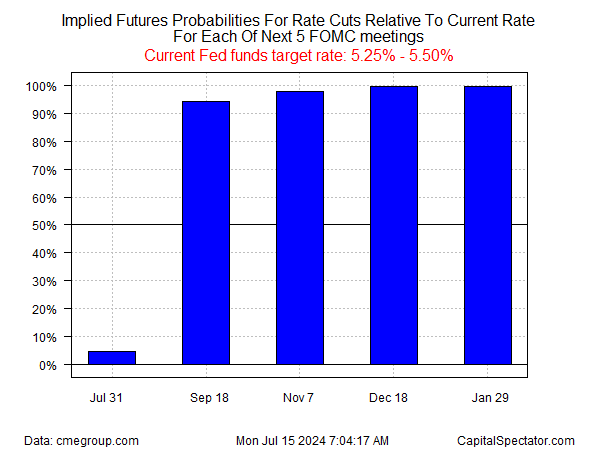

Fed funds futures are now pricing in a high probability (90%-plus) that the central bank will start cutting rates at the Sep. 18 FOMC policy meeting. That’s up sharply from a roughly 65% probability estimate on July 3. (Meanwhile, no cut is expected for the next meeting on July 31.)

The policy-sensitive US 2-year Treasury yield is also pricing in a softer Fed funds target rate. On Friday, this key maturity fell to 4.19%, the lowest since late-March, marking more than 100 basis points below the current 5.25-to-5.50% Fed funds target range.

Meanwhile, a Fed funds model I developed for TMC Research also points to a lower target rate. Using data through July 8, this model estimated the optimal target rate at roughly 4.75%, which suggests a 50-basis-point cut is optimal.

A crucial economic report this week will be widely read for fresh clues on the outlook for monetary policy: tomorrow’s US retail sales report for June (Tues., July 16). Economists expect spending to turn slightly negative for the monthly comparison, according to Econoday.com survey data.

If correct, the weak retail data will provide more evidence that the recent slowdown in consumer spending continues, which in turn will support the crowd’s view that a rate cut is on the near-term horizon.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno