Materials And Energy Stocks Take Early Lead in 2026

The ledger of stock market’s winners and losers is highlighting a substantially different race so far in 2026, based on a review equity sectors… But for now, it’s obvious that sentiment has shifted in favor of shares in the materials and energy sectors, based on a set of ETFs through yesterday…

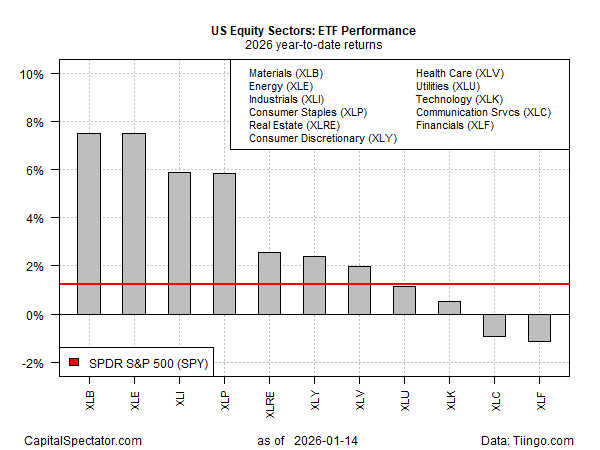

The ledger of stock market’s winners and losers is highlighting a substantially different race so far in 2026, based on a review equity sectors. The year is still young and so it’s unclear if a durable change in leadership is unfolding relative to last year’s bull run. But for now, it’s obvious that sentiment has shifted in favor of shares in the materials and energy sectors, based on a set of ETFs through yesterday’s close (Jan. 14).

Currently tied for first place in 2026: materials (XLB) and energy (XLE), each fund posting a 7.5% rise. The rallies are comfortably ahead of the third- and fourth-place winners, which are also in a dead heat so far in 2026 via industrials (XLI) and consumer staples (XLP), with 5.9% gains each. The US stock market overall, via SPDR S&P 500 (SPY), is trailing with a 1.2% year to date increase.

The current leadership is striking following modest gains for materials (XLB) and energy (XLE) last year. In both cases, the 2025 performances trailed the sector leaders – tech (XLK) and communications (XLC) – by wide margins.

The one sector that’s extending a strong run in 2025 into the new year: industrials (XLI). Posting a competitive third-place finish last year, industrials continue to run hot so far in 2026.

It’s anyone’s guess if the renewed focus on commodities and related sectors will remain the dominant theme for the year ahead from a sector perspective, but the odds look encouraging so far, based on technical profiles. XLI, for instance, continues to reflect a solid bullish trend.

It’s premature to dismiss the AI-fueled rally in tech that consumed 2025’s headlines, but after a strong run investors appear to be looking to relative laggards for opportunities that are less frothy.

“Hedge funds rotated billions from tech stocks into defensive sectors during Q4 2025,” the web site 24/7 Wall Street recently reported. “The trend continued into January 2026.”

Author: James Picerno