Mixed Risk-Appetite Signals Sharpen Debate For Markets Outlook

The ratio of aggressive allocation (AOA) vs… conservative allocation (AOK) has suffered a bout of volatility recently, but the ratio’s 50-day average continues to print well above its 200-day counterpart… This ratio is showing weakness lately…Another proxy that suggests risk-off…

Recent market volatility has raised questions about the staying power of the rally for global assets that began in late-2023. A clear warning sign has yet to emerge, based on a set of ETF pairs that measure the broad trend via prices through Sep 18. But in some corners there are hints that the tide may be turning.

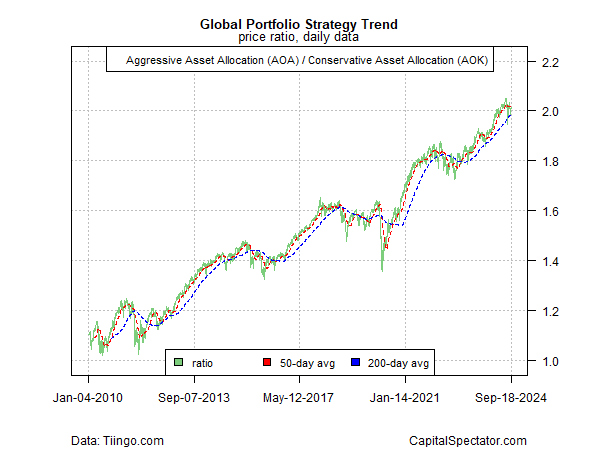

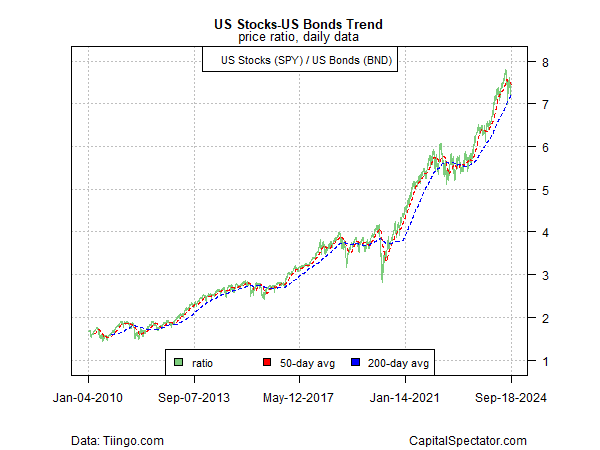

Let’s start with the big-picture, which remains relatively upbeat. Using two global asset allocation ETFs as a proxy, the bull trend has wobbled but the bias remains net positive. The ratio of aggressive allocation (AOA) vs. conservative allocation (AOK) has suffered a bout of volatility recently, but the ratio’s 50-day average continues to print well above its 200-day counterpart. Although this metric doesn’t offer much traction for short-term trading, its value as a first approximation of the medium-term trend suggests that it’s still premature to confidently assume that the risk-on bias has run its course. Similar signaling has been consistent in these updates in recent months – on Aug. 8 and July 8, for instance.

Focusing on US stocks, however, points to a more precarious profile, based on the trend for a broad market proxy (SPY) vs. a low-volatility portfolio of American equities (USMV). This ratio is showing weakness lately. Notably, the 50-day average for SPY:USMV slipped below its 200-day counterpart yesterday – the first downside-trend signal for these averages since early 2022, which presaged an extended slide for US stocks. One data point should be viewed cautiously, but this weakness should be monitored closely as a possible early warning for risk appetite — a view that will strengthen if the downside bias continues and deepens in the days and weeks ahead.

There’s also ongoing weakness in recent history for the high-flying corner of semiconductor stocks relative to US shares overall (SPY). Semi shares are often used as a proxy for the business cycle and so further declines in this corner would be viewed as a possible early warning for the economic outlook.

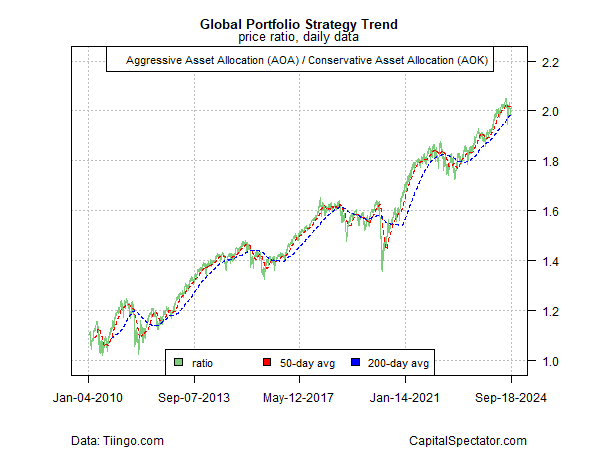

Meanwhile, the safe-haven proxy for utilities stocks (XLU) vs. the broad US market (SPY) has rebounded lately, marking a shift from an extended slide. Taken at face value, this change indicates a shift to risk-off in market sentiment.

Another proxy that suggests risk-off sentiment is strengthening: the ratio of medium-term Treasuries (IEF) vs. shorter-term counterparts (SHY). As this indicator rises, it can be interpreted as signaling a change in sentiment, namely, a shift to risk-off.

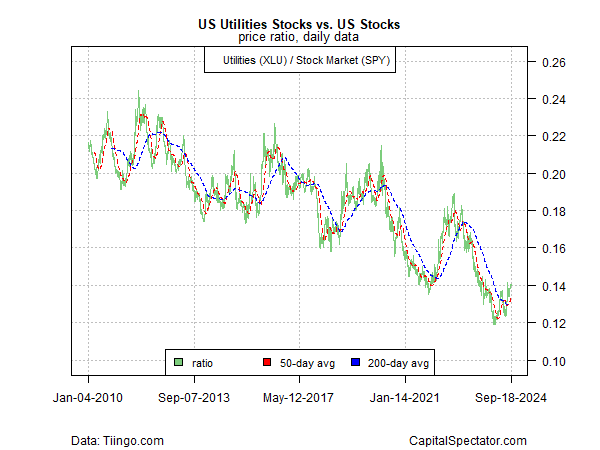

By contrast, there’s still room for debate vis-à-vis the ratio of US stocks (SPY) vs. a broad measure of US bonds (BND). Although this indicator has stumbled recently, it’s yet to signal a clear risk-off signal. It could be telling if this ratio drops in the weeks ahead.

One takeaway from the trend data above: there’s a stronger case for adopting a more defensive posture, if only on the margins. This is especially true for investors with a low risk tolerance and/or a relatively short time horizon for de-accumlation plans. For longer-term investors it’s reasonable to wait and assume that recent market volatility may be noise. Indeed, if your investment horizon extends at least 5-10 years, the last several months still looks like noise for a globally diversified multi-asset class portfolio, which is expected to generate solid results for patient capital.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno