Moderate, Steady Growth Expected For US Q1 GDP

For example, some analysts advise that a higher degree of inflation risk lurks in the near term due to plans to raise tariffs… The risk arrives at a potentially vulnerable point when inflation metrics published to date continue to reflect so-called sticky inflation… Last week, the government…

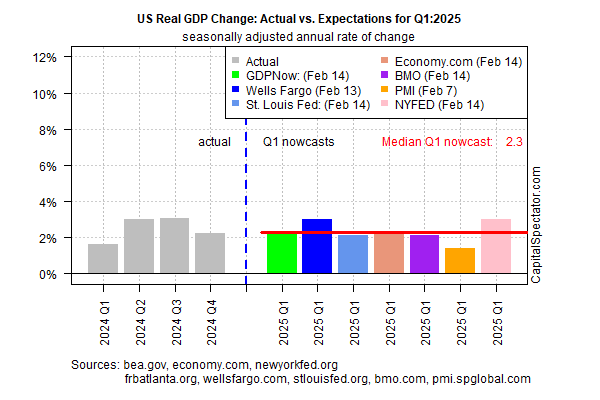

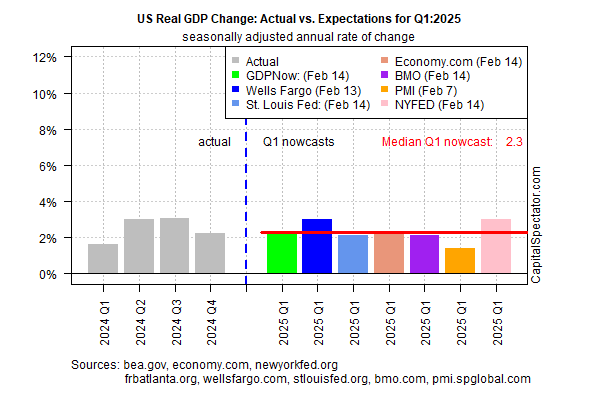

US economic activity is on track to maintain a moderate growth rate in 2025’s first quarter, according to the median for several nowcasts compiled by CapitalSpectator.com. Today’s initial Q1 estimate projects that the 2%-plus pace reported for Q4 by the Bureau of Economic Analysis (BEA) will continue in the current quarter.

Output appears set to rise 2.3% (annualized real rate), according to the median nowcast. If correct, growth will match Q4’s advance.

The standard caveat applies this early in the quarter for the simple reason that a lot can change between today and April 30, when BEA publishes its initial estimate of the official GDP data. In addition to the usual uncertainty that surrounds yet-to-be published numbers that will influence the Q1 GDP report, there’s an extra layer of ambiguity related to various policy changes prioritized by President Trump.

For example, some analysts advise that a higher degree of inflation risk lurks in the near term due to plans to raise tariffs. The risk arrives at a potentially vulnerable point when inflation metrics published to date continue to reflect so-called sticky inflation. Last week, the government reported that consumer inflation continued to accelerate, rising 3.0% in January vs. the year-ago level — the highest since last June.

One implication: the Federal Reserve is unlikely to extend rate cuts in the near term and, depending on incoming inflation data, may be forced to raise rates. There’s also a possibility that a stronger inflation headwind will slow economic activity.

For the moment, however, the US economy still looks relatively resilient, as today’s Q1 GDP nowcast suggests. But with US economic policy in a state of flux on several fronts, there’s room for debate about the implications for growth.

A useful benchmark to monitor for assessing how expectations change is the median GDP nowcast updated on these pages. The first question: Will today’s moderate growth estimate for Q1 hold steady through the next round of data updates over the next several weeks? Stay tuned to CapitalSpectator.com for regular updates.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno