New Research Highlights Value Of Forecasts From Betting Markets

The latest twist on this idea arises from betting markets… A study published last month from the National Bureau of Economic Research finds that the forecasts from Kalshi, an online betting market, offers forecasts that are “comparable” in accuracy to “established benchmarks such as the Sur…

Predicting is hard, especially about the future, runs an old joke. Does the “wisdom” of crowds help? There’s a long line of research suggesting it does. Combining forecasts from several models, for example, has an encouraging track record of outperforming any one model as a general rule. The latest twist on this idea arises from betting markets. As researchers study these sites and compares their forecasts with the usual suspects, the results reaffirm the value of the crowd’s view.

A pair of recent working papers dives into the details. A study published last month from the National Bureau of Economic Research finds that the forecasts from Kalshi, an online betting market, offers forecasts that are “comparable” in accuracy to “established benchmarks such as the Survey of Market Expectations and the Bloomberg consensus.” The authors add:

In several cases, they provide unique insights—particularly for variables like GDP growth, core inflation, unemployment, and payrolls, for which no other market-based distributions currently exist. We have also argued that they provide the only credible measures of distributional beliefs about decisions at specific FOMC meetings.

Another group of economists studied earnings expectations from Polymarket and report:

Our analysis demonstrates that prediction markets are efficient aggregators of information: they significantly outperform sell-side analysts in predictive accuracy and possess significant incremental explanatory power for earnings announcement returns. Furthermore, while analysts systematically underestimate earnings and exhibit underreaction, prediction market expectations are unbiased in levels and largely consistent with rational benchmarks, though we do observe short-term overreaction. Finally, we show that prediction markets lead price discovery for earnings-related information, incorporating new information before analyst forecast revisions.

“Getting information from a large pool of people can be a remarkably good form of forecasting,” said Jonathan Wright, an economics professor at Johns Hopkins University who co-wrote the NBER paper.

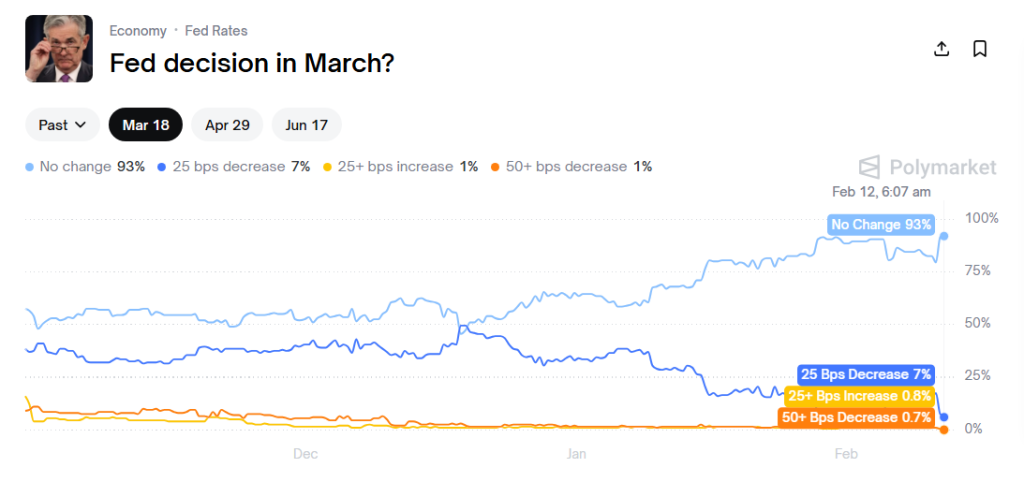

With that in mind, let’s check in on the latest forecasts for several upcoming macro events, starting with the next month’s policy decision at the Federal Reserve. Echoing recent history, the crowd expects the Fed to leave rates steady.

For the delayed fourth-quarter GDP report scheduled for later this month, a moderate downshift to 3.2% is expected. That’s still in line with the two previous quarterly reports in suggesting that output will continue to increase at a robust pace.

Tomorrow’s consumer inflation report for January is expected to edge higher to a ~2.8% year-over-year pace, up from 2.6% in December.

Finally, on the question of whether the US stock market (S&P 500) will post a gain for all of 2026, the current view is a moderately confident “yes”:

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Author: James Picerno