Price analysis 10/25: BTC, ETH, BNB, XRP, SOL, ADA, DOGE, TON, LINK, MATIC

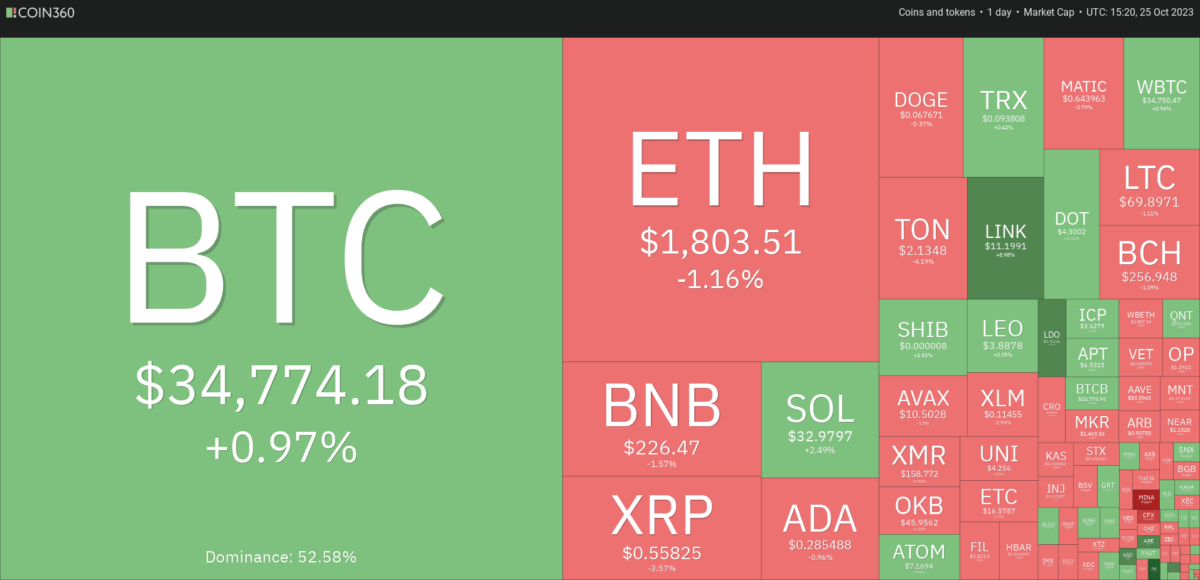

Usually, the price tends to consolidate or hesitate near stiff overhead resistance levels but that was not the case this time around… Source: Coin360The rush to buy Bitcoin before the consent for a spot Bitcoin ETF is received is because analysts expect the prices to surge after the green light i…

Bitcoin’s break above $32,400 points to the continuation of the bull move, but will traders be able to sustain the current momentum?

Bitcoin (BTC) easily soared above the $31,000 to $32,400 resistance zone on Oct. 23, which came as a suprise to many market participants. Usually, the price tends to consolidate or hesitate near stiff overhead resistance levels but that was not the case this time around.

Market participants are bullish as they anticipate a Bitcoin spot exchange-traded fund to receive approval sooner rather than later. Bloomberg ETF analyst Eric Balchunas said in a post on X (formerly Twitter) on Oct. 23 that the listing of BlackRock’s spot Bitcoin ETF on the Depository Trust & Clearing Corporation (DTCC) was “all part of the process” of bringing the ETF to market. He added that it was “hard not to view this as them getting signal that approval is certain/imminent.” However, a DTCC spokesperson later said that the listing of the said ETF has been there since August and it being there does not signal any regulatory approval.

The rush to buy Bitcoin before the consent for a spot Bitcoin ETF is received is because analysts expect the prices to surge after the green light is received. Galaxy Digital research associate Charles Yu said in a blog post that Bitcoin’s price may rally by 74.1% in the first year after an ETF is launched in the United States.

Is the recent rally in Bitcoin the beginning of a sustained strong up-move, or is it time to book profits? How will altcoins behave as Bitcoin price shows strength?

Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin skyrocketed above the stiff overhead barrier of $31,000 to $32,400 on Oct. 23. This indicates the resumption of the uptrend.

The sharp rally of the past few days has sent the relative strength index (RSI) deep into the overbought territory. Sometimes, in the initial stages of a new bull move, the RSI tends to stay in the overbought zone for a long time.

The important support to watch on the downside is $32,400 and then $31,000. Buyers are expected to defend this zone with vigor. If the price turns up from this support zone, the bulls will attempt to drive the BTC/USDT pair to $40,000.

Conversely, a fall below $31,000 will indicate that the recent breakout may have been a bull trap.

Ether price analysis

Ether’s (ETH) range resolved to the upside with a break above $1,746 on Oct. 23, indicating a potential start of a change in trend.

The bulls tried to stretch the rally on Oct. 24 but the long wick on the candlestick shows strong selling at higher levels. The important level to watch on the downside is $1,746. If bulls hold this level during the retest, the ETH/USDT pair may jump above $1,855. That could open the doors for a rally to $1,900 and then to $2,000.

The bears are likely to have other plans. They will try to drag the price back below $1,746 and trap the aggressive bulls. The pair may then slump to the 20-day EMA ($1,648). Such a move will suggest that the pair may extend its consolidation for some more time.

BNB price analysis

BNB (BNB) rallied above the immediate resistance of $223 on Oct. 23 but the bulls could not maintain the momentum and clear the hurdle at $235.

Sellers are trying to pull the price back below $223. If they manage to do that, it will suggest that the BNB/USDT pair may swing between $203 and $235 for a while longer.

The 20-day EMA ($215) has started to turn up and the RSI is in the positive territory, indicating that bulls have the upper hand. If the price turns up from $223, it will suggest that the bulls are buying on dips. That will improve the prospects of a rally above $235. The pair may then start a rally to $250 and eventually to $265.

XRP price analysis

XRP (XRP) has been oscillating inside the large range between $0.41 and $0.56 for the past several months. The bulls pushed the price above the resistance of the range on Oct. 24 but the long wick on the candlestick shows that the bears are trying to guard the level.

In a range, traders generally sell near the overhead resistance and that is what is seen in the XRP/USDT pair. If the price reaches the moving averages, it will suggest that the pair may remain inside the $0.56 to $0.46 range for a few more days.

Instead, if the price turns up from the current level and breaks above $0.56, it will indicate the start of a new up-move. The pair may first rise to $0.66 and thereafter attempt a rally to $0.71.

Solana price analysis

Solana (SOL) reached the pattern target of $32.81 on Oct. 23 where traders may have booked profits. That started a correction on Oct. 24 which was short-lived.

This suggests that the sentiment remains bullish and every minor dip is being purchased. Buyers pushed the price above $32.81 on Oct. 25, indicating the start of the next leg of the uptrend. The SOL/USDT pair may next skyrocket to $38.79.

The RSI remains in the overbought territory, indicating that the pair is at risk of witnessing a minor correction or consolidation in the near term. If the price slips below $29.50, the pair may tumble to $27.12. This level is likely to witness strong buying by the bulls.

Cardano price analysis

Cardano (ADA) jumped above the $0.28 resistance on Oct. 24 but the long wick on the candlestick shows that the bears are selling at higher levels.

The ADA/USDT pair is likely to witness a tough battle near the $0.28 mark. If the price slips and sustains below this level, it will indicate that the markets have rejected the breakout. That could keep the pair inside the $0.24 to $0.28 range for some more time.

On the contrary, if the price rebounds off $0.28 and rises above $0.30, it will suggest that the bulls have flipped the level into support. That could start a new up-move toward $0.32. If this level is taken out, the pair may start its march toward $0.38.

Dogecoin price analysis

Dogecoin’s (DOGE) rally met with heavy selling at $0.07 on Oct. 24 as seen from the long wick on the day’s candlestick.

The DOGE/USDT pair may enter a period of correction or consolidation in the near term. During that time, if the pair does not give up much ground, it will suggest that the bulls are not closing their positions in a hurry. That will enhance the prospects of a break above $0.07. The pair may then surge to $0.08.

The bullish crossover on the moving averages and the RSI in the overbought territory shows that bulls are in command. This advantage will tilt in favor of the bears if they drag the price below $0.06.

Related: Matrixport doubles down on $45K Bitcoin year-end prediction

Toncoin price analysis

Toncoin (TON) turned down from $2.26 on Oct. 24, indicating that the bears are defending the resistance at $2.31.

The first support on the downside is at the moving averages. If the price rebounds off this level, it will suggest that the sentiment is positive and traders are buying the dips. That will increase the likelihood of a break above $2.31. If that happens, the TON/USDT pair could retest the formidable resistance at $2.59.

Contrarily, if the price turns down and breaks below the moving averages, it will suggest that the pair may consolidate between $1.89 and $2.31 for some time. The bears will be back in the driver’s seat if they sink the price below $1.89.

Chainlink price analysis

Chainlink (LINK) broke out of a multi-month consolidation on Oct. 22 when buyers drove the price above the overhead resistance of $9.50.

Sellers tried to tug the price back below the breakout level of $9.50 on Oct. 24 but the long tail on the candlestick shows aggressive buying at lower levels. The buying resumed on Oct. 25 and the LINK/USDT pair has continued its journey higher. The pattern target of the breakout from $9.50 is $13.50 but if this level is crossed, the pair may reach $15.

If bears want to prevent the upside, they will have to pull the price back below $9.50. The overbought levels on the RSI alert traders that a minor correction or consolidation is possible in the near term.

Polygon price analysis

Polygon (MATIC) surged above the $0.60 resistance on Oct. 22, indicating accumulation at lower levels.

The 20-day EMA ($0.56) has started to turn up and the RSI is in the overbought territory, signaling a potential trend change. If buyers maintain the price above $0.60, it will suggest the start of a new up-move. The MATIC/USDT pair could rise to $0.70 and then to $0.80.

The important level to watch on the downside is $0.60. A break below this level will suggest that the rally above $0.60 may have been a fake-out. That could trap the aggressive bulls, resulting in a drop to the moving averages.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Author: Rakesh Upadhyay