The Case For Portfolio Rebalancing Looks Compelling

The question, as always, is when is it timely to take some of the winnings and redeploy to other assets classes?There are countless ways to engage in opportunistic portfolio rebalancing analytics, but a good way to start is by profiling performance… The future’s uncertain as always, of course…

By nearly any measure you cite, US equities are enjoying a stellar run. Despite numerous global risks, investor sentiment for American shares is resilient. The question, as always, is when is it timely to take some of the winnings and redeploy to other assets classes?

There are countless ways to engage in opportunistic portfolio rebalancing analytics, but a good way to start is by profiling performance. For US equities, the case for tamping down expectations looks persuasive. To the extent that expected return evolves inversely with trailing performance, recent history provides a baseline for thinking about risk.

Meanwhile, the view that the bear-market for bonds is over is attracting more attention. The future’s uncertain as always, of course, but one can argue that the foundation is in place for a round of portfolio rebalancing.

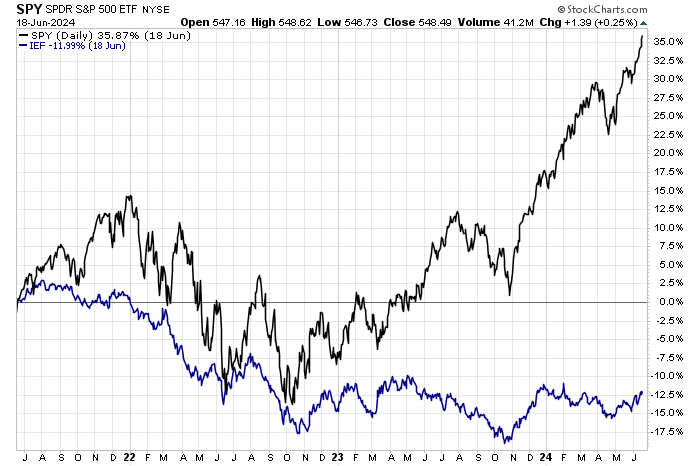

Consider how US stocks and Treasuries compare over the past three years, based on a set of ETFs: SPY for equities and IEF for government bonds. The divergence is a chasm.

As I wrote earlier this week, a multi-factor measure of the directional bias for Treasury yields suggests that the worst for the bear market in bonds has passed (see chart below). Other analysts are coming to the same conclusion. We’ve seen the peak in yields,” says Stephen Miller, an investment strategist at GSFM in Sydney. “Bonds are now back as having a deserved place in a multi-asset portfolio.”

US Treasuries (IEF) are starting to show an upside bias lately. Although it’s still early for the rebound narrative, it’s plausible that we’re in the early stages of an extended rebound. If so, the odds are beginning to tip in favor of a bullish view for bonds.

Meanwhile, US stocks appear overextended. Let’s start with a rolling one-year-return profile for the S&P 500 Index. The 24% rise over the past year (through June 18) has yet to reach the extreme peaks in history, but it’s clearly at a lofty level that’s rarely experienced.

For a clearer view of how the S&P’s current one-year change compares with decades past, the next chart reminds that a 24% increase is well above the inter-quartile range that (gray box) that marks the lion’s share of the return distribution for the past 60 years-plus.

Taking a longer-term view, it’s also clear that the trailing 10-year return for the S&P 500 is also elevated. The 10.9% annualized gain for the index is currently at the 75th percentile.

To be clear, you can’t make reliable near-term forecasts based on the analysis above, but you can weigh the implied odds for what may come next. But let’s not forget that the market is convinced that several factors have aligned so that US equities deserve to be favored over most other asset classes. When, or if, that sentiment bias will change is anyone’s guess.

From a calculated-risk perspective, however, the odds are starting to favor rebalancing. The case is especially compelling for portfolios holding bonds that are well below target weights, a.k.a. portfolios allocated to US stocks at levels well above targets.

Author: James Picerno