US Isn’t In Recession Now, But Downturn Risk May Be Rising

How do we square the relatively upbeat published data with the sudden downside shift in sentiment? Economist Paul Krugman tries to bridge the gap and writes: “The economy is looking pre-recessionary… Friday’s employment report triggered the Sahm rule, which says that a sufficiently large rise…

Judging by the current numbers, the US expansion almost certainly endures. There are well-founded concerns that the tide may be turning, but that’s still a speculative call. By comparison, published numbers to date, overall, speak clearly: growth still has the upper hand. That’s not written in stone, of course, but for this specific point in time it’s the odds-on favorite for describing current conditions.

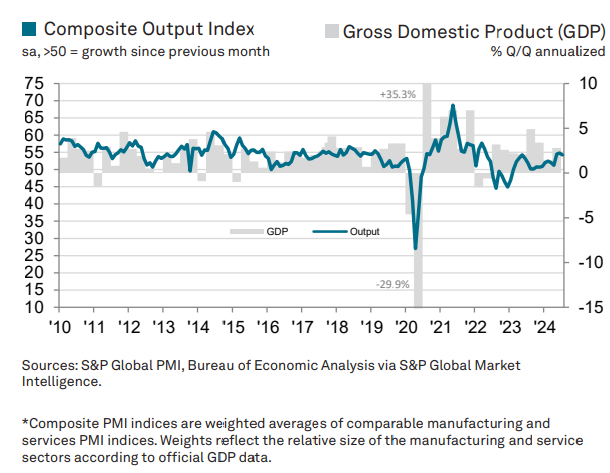

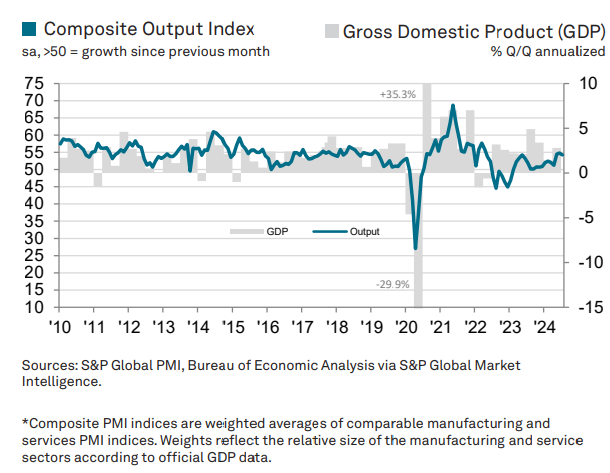

That’s the message in yesterday’s update of the US Composite PMI Output Index for July, a survey-based GDP proxy. The 54.3 reading, down a bit from June’s 54.8, remains well above the neutral 50 mark. “The PMI surveys bring encouraging news of a welcome combination of solid economic growth and cooler selling price inflation in July,” says Chris Williamson, chief business economist at S&P Global Market Intelligence.

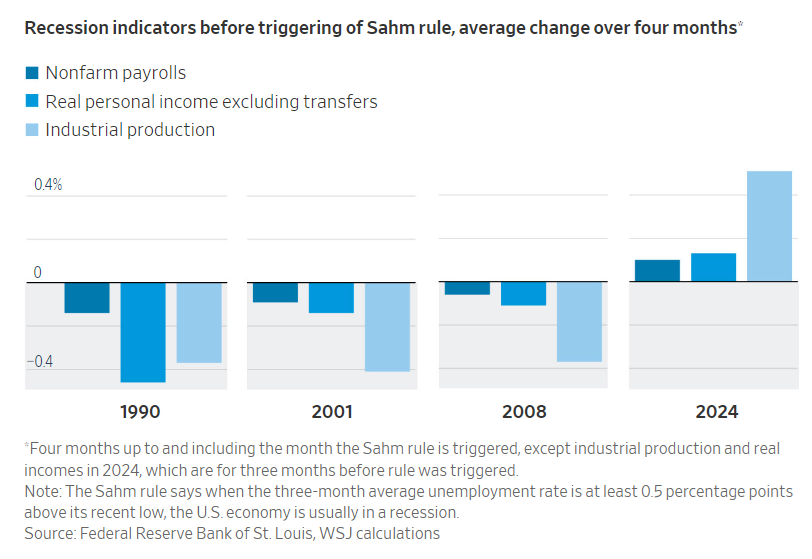

Reviewing trends in the hard data offers a similar profile. The Wall Street Journal, for example, reports that several key indicators — non-farm payrolls, real personal income and industrial production — are still posting a growth bias in the latest comparisons. The upside trends contrast with downside comparisons ahead of previous economic downturns.

The near-term future, however, is looking darker, according to market sentiment and some economic forecasters. How do we square the relatively upbeat published data with the sudden downside shift in sentiment? Economist Paul Krugman tries to bridge the gap and writes: “The economy is looking pre-recessionary.”

The most important factor is the unemployment rate, which has been gradually trending up over the past few months. Friday’s employment report triggered the Sahm rule, which says that a sufficiently large rise in the unemployment rate is a strong indication that a recession has started. Many economists, including Claudia Sahm, who devised the rule, believe that for a variety of technical reasons things may not be as dire as they look. But even so, the situation is worrisome.

The National Bureau of Economic Research (NBER) publishes the gold standard for dating US recession and expansion turning points. Unfortunately, the real-time value for NBER’s methodology is nil. Its near-flawless historical analytics are rarely, if ever, questioned for the rear-view mirror perspective, but that comes at a cost of arriving with a lag (sometimes significantly so) for assessing current conditions.

In an effort to estimate the NBER signal in real time, I developed a multi-factor, ensemble modeling approach to fill in the missing real-time gaps via the weekly updates of The US Business Cycle Research Report, which I’ve been publishing for well over a decade. Although the newsletter’s track record isn’t perfect, it’s proven to be invaluable if only as a reality check based on data at times when behavioral risk is high.

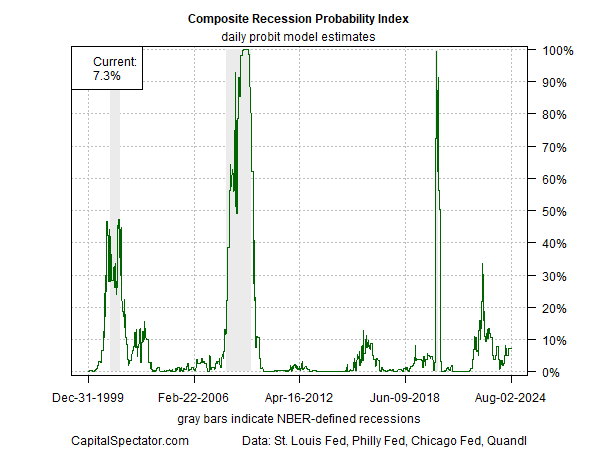

With that in mind, the Aug. 3 edition of The US Business Cycle Research Report advises: “Softer-than-expected growth in US payrolls in July triggered concerns that recession risk is rising, but the case is weak for confidently declaring that a downturn has started or is imminent.”

The primary source for that view is the newsletter’s main index – Composite Recession Probability Index (CRPI), which aggregates business-cycle signals from a variety of sources (external and proprietary) to estimate the probability that an NBER-defined recession is underway or will be soon. On that front, the current profile still skews heavily toward growth.

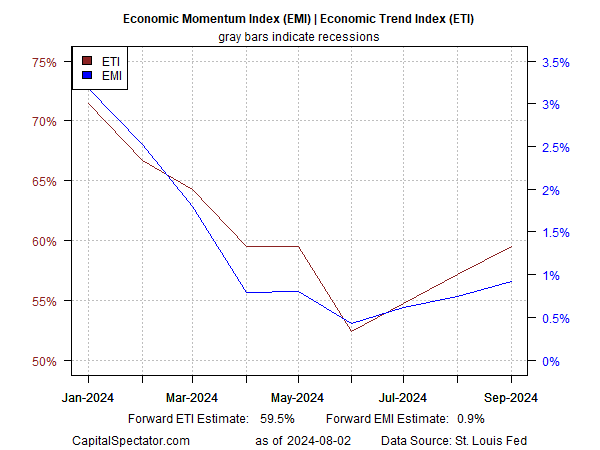

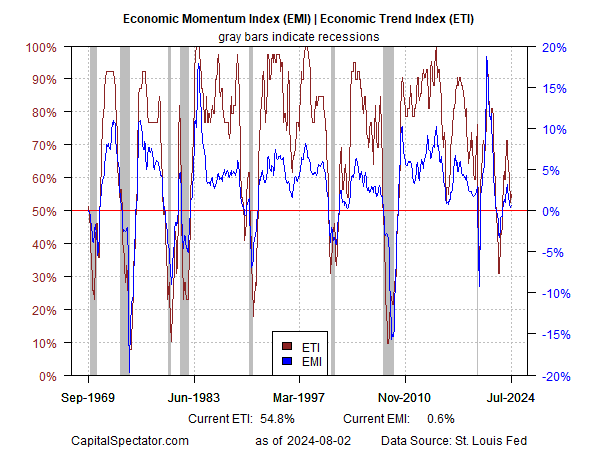

Another modeling approach in the newsletter focuses on projecting the near-term macro trend for the US forward by one to two months (the limit for making relatively high-confidence estimates of economic activity). On that front, forward estimates of the Economic Trend Index and Economic Momentum Index point to a modest strengthening through September that puts a bit more distance between the benchmarks and their respective tipping points that mark recession.

Historically, ETI and EMI have been valuable real-time estimates for current economic conditions.

On that basis, the case for assuming that recession risk has spiked still looks weak. To be fair, no one can ever be 100% certain in the realm of real-time business-cycle analytics. But reviewing a broad set of numbers still favors a growth bias.

That said, your editor is on high alert for compelling reasons to update the outlook. But any revisions should be based on data rather than warm and fuzzy speculation. On that score, the future will continue to arrive one data point at a time.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Author: James Picerno