Was April’s Correction Noise Or Signal For Global Markets?

One thing that is clear in the shift in rate-cut expectations: Fed funds futures this morning are pricing in moderately high odds for the first rate cut in September, a conspicuous shift from a week ago…April was a rough month for investors, but the rebound in asset prices in the early days of Ma…

April was a rough month for investors, but the rebound in asset prices in the early days of May has revived expectations that the worst has passed. A key catalyst for the turnaround in sentiment: Friday’s US payrolls data, which posted a substantially softer-than-expected rise in April. The crowd views the news as a net positive because it lifts the odds that the Federal Reserve will cut interest rates this year.

Even if this view is correct, which is open for debate, it’s not without risk for markets. Much depends on how fast and how far the US economy slows. A modest degree of cooling will probably help soften inflation, which has been firmer than expected in recent updates. But the deceleration in economic activity could come back to bite if the slowdown has substantial downside momentum.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

“It feels a little early to declare that the US economy has made a soft landing since the Fed still is holding interest rates at restrictive levels,” says Comerica Bank chief economist Bill Adams. “But the April jobs report helps clear a path to that destination.”

For some analysts, however, the risk of the economy slowing more than the consensus assumes is significant. “The reason I think the Fed’s going to see enough to cut [interest rates] is because we’re more toward the hard landing end of the spectrum,” advises Citi chief US economist Andrew Hollenhorst.

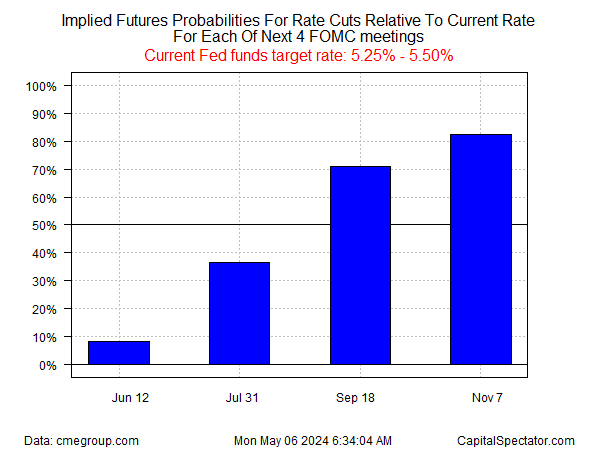

One thing that is clear in the shift in rate-cut expectations: Fed funds futures this morning are pricing in moderately high odds for the first rate cut in September, a conspicuous shift from a week ago.

The bond market supports the latest dovish pivot: the policy-sensitive 2-year US Treasury yield starts the trading week at 4.83%, reflecting last week’s sharp drop that leaves this rate at its lowest level in nearly a month.

The caveat is that there are several moving parts for assuming a best-case scenario comprised of softer inflation and a mild slowdown in economic activity that trims inflation’s sails, reduces interest rates but without strengthening headwinds for earnings and the stock market. That’s a tall order, but one that’s suddenly back in vogue as a plausible path.

The week ahead will test the durability of this Goldilocks scenario, although the light schedule for US economic releases probably won’t provide much news one way or the other.

The key event to watch arrives next week with the release of US consumer prices for April (due on May 15). CapitalSpectator.com’s ensemble model projects that the stalled disinflation of late will resume in April for the year-over-year change in core consumer prices. For the moment, markets are inclined to agree.

For good or ill, next week’s CPI report will be “informing the path of monetary policy and the market’s pricing of that path,” explain a Morgan Stanley team of analysts led by Michael Wilson in a research note. “The price reaction on the back of this release may be more important than the data itself given how influential price action has been on investor sentiment amid an uncertain macro set up.”

Author: James Picerno